Wondering how to calculate Professional Tax (PT) for running payroll? Are you confused about the payment and return filing of the professional tax? Drop all your worries as I have got you covered. ‘How’, you ask? Well, keep reading to unfold the ultimate guide to professional tax.

In this blog:-

- What is Professional Tax (PT)?

- What is salary as per Professional Tax (PT)?

- Who is responsible for deducting Professional Tax (PT)?

- How to deduct Professional Tax (PT) on payroll?

- Karnataka Professional Tax (PT)

- What is the tax slab for 2020 in Karnataka?

- How to register for the tax in Karnataka?

- How is PT calculated in Karnataka?

- When to pay PT in Karnataka?

- How to pay Karnataka professional tax online?

- How to file a return in Karnataka?

- What is the penalty on the late payment of professional tax in Karnataka?

- Maharashtra Professional Tax (PT)

- What are the PT slabs in Maharashtra?

- How to register for the tax in Maharashtra?

- How is PT calculated in Maharashtra?

- What is the due date for PT in Maharashtra?

- How to pay professional tax online in Maharashtra?

- How to file returns in Maharashtra?

- What is the penalty for the late filing of professional tax in Maharashtra?

- Telangana Professional Tax (PT)

- What are the PT slabs in Telangana?

- How to register for the tax in Telangana?

- How is PT calculated in Telangana?

- What is the due date for payment of PT in Telangana?

- How to pay professional tax online in Telangana?

- How to file a return in Telangana?

- What is the penalty for the late filing of professional tax in Telangana?

- West Bengal Professional Tax (PT)

- What is the rate of PT in West Bengal?

- How can I get a registration certificate in West Bengal?

- How is PT calculated in salary in West Bengal?

- What is the due date for payment for PT in West Bengal?

- How to pay WB professional tax online?

- How to file a return in West Bengal?

- What is the interest on the late payment of professional tax in West Bengal?

- What are PTEC and PTRC?

- Wrap-up

- FAQs

What is Professional Tax (PT)?

Professional tax is an indirect tax levied by the State government. Although the name suggests that it is a tax levied only on professionals, it is not quite so. On the contrary, any individual who earns an income from a salary, or is engaged in a profession or trade, has to pay this tax. In other words, the taxpayer may be an employee, a professional, a freelancer, a businessman, or others. As per Section 16 (iii) of the Income Tax Act, 1961, the tax is deductible from an employee’s gross income.

What is salary as per Professional Tax (PT)?

According to professional tax regulations, salary is the income of an individual. Such salary is inclusive of payment, dearness allowance, and prerequisites or perks received by the individual. Further, it includes allowances in both cash and kind which are received periodically. Above mentioned salary refers to the income of professionals as well. Also, it includes merchants, traders, contract-workers, and more, besides salaried employees in an organization.

Also Read: Understanding the salary structure in India

Who is responsible for deducting Professional Tax (PT)?

As far as salaried employees are concerned, the employer is responsible for deducting their PT. But, in the case of other individuals who are not salaried employees, they have to pay their own tax. As mentioned before, such individuals include professionals, freelancers, traders, merchants, and more.

Article 246 of the Constitution of India lays down that only Parliament is vested with the power to make laws by the Union List. The Union List includes taxes on income. On the other hand, the Concurrent and State lists come under the jurisdiction of the State government. Likewise, the State government is in charge of collecting and making changes to professional tax. Hence, after deducting an employee’s PT, the employer is liable to submit it to the State government.

How to deduct Professional Tax (PT) on payroll?

In order to seamlessly manage professional tax compliance on payroll, you need an HR management software. Hence, a cloud HR software might be exactly what you are looking for. Not only are they easily accessible, but also time and cost-efficient.

Having doubts as to why you should use a payroll software? Because, not only will employees get paid on time, but also there will be accurate tax deductions. Besides, it provides you the feature of tracking employees’ work locations. Amidst the pandemic, this is a great bonus point. In other cases too, employees can conduct work from different states. As a result, they have to abide by the professional tax rules of the respective states. This is where the feature of work locations come to play. Another pitfall of calculating taxes on payroll arises when you have to do it manually. But it’s time to bid adieu to that.

A good HR software, like Asanify , makes digitally automated calculations. This, in turn, leads to correct tax deductions on payroll. In fact, Asanify also makes automated payments, making your work a notch easier. What are you waiting for? Get started for FREE, now!

Karnataka Professional Tax (PT)

What is the tax slab for 2020 in Karnataka?

The slabs for professional tax in Karnataka are as follows:-

| Gross Monthly Salary | Monthly Tax Payable |

| Up to Rs 15,000 | Nil |

| Rs 15,001 and or above | Rs. 200 |

How to register for the tax in Karnataka?

In Karnataka, there are two types of registration for this tax:-

Professional Tax Employer Registration

This is a mandatory registration for all companies and businesses. The enrollment certificate (EC) is the certificate for registration. The following are the tax slabs for employers, as per Karnataka Shops and Commercial Establishments Act, 1961:

- No employees – No tax implications

- 1-5 employees – INR 1000

- 5-10 employees – INR 1,500

- More than 10 employees – INR 2,500

Professional Tax Employee Registration

The tax from employees is deducted from the employer, as well. Hence, the Registration Certificate (RC) is also acquired by employers. There are two modes of tax returns to choose from here. That is, there is an option of either monthly or annual returns.

How is PT calculated in Karnataka?

In Karnataka, professional tax is calculated on the total income. That is before deducting PF (Provident Fund), ESIC(Employees’ State Insurance Corporation), etc. If this amount exceeds INR 15,000 per month, then an individual is liable to pay INR 200 as tax.

When to pay PT in Karnataka?

For an annual payment of professional tax, the due date is 30th April of each year. On the other hand, for monthly payments, the deadline is the last date of the month.

How to pay Karnataka professional tax online?

To make an online payment for professional tax in the state of Karnataka, you need to follow these steps

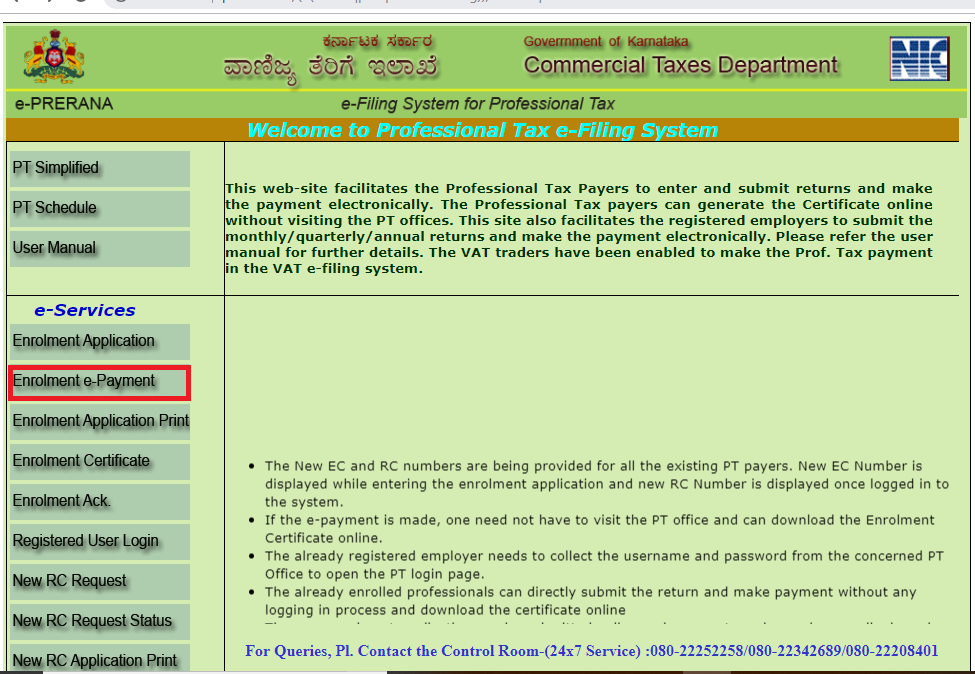

Step 1: Open portal

Open the e-PRERANA portal in your browser.

Step 2: Select the e-Payment option

You will get the ‘Enrolment e-Payment’ option under the left sidebar under the head ‘e-Services’.

Step 3: Make payment

After that fill in the PTR number and PTR date. Then click on ‘Go’. Finally, make the payment.

Note: PTR number is a unique number that you get when you first register at the site.

How to file a return in Karnataka?

Just like payment of tax, its return can also be filed through the e-PRERANA website. Moreover, you have to file the tax return within 60 days before the given year ends. Additionally, returns have to be filed within 24 days since the month for which the payment is made.

What is the penalty on the late payment of professional tax in Karnataka?

If you fail to pay the tax on time, the Karnataka State government will levy interest of 1.25% per month, on the amount of tax to be paid. Although, the maximum penalty on late payment of tax in Karnataka is an interest of 50%. This is to be levied on the total unpaid amount of tax.

Maharashtra Professional Tax (PT)

What are the PT slabs in Maharashtra?

Given below are the rates of professional tax in Maharashtra:-

| Gross Monthly Salary | Monthly Tax Payable |

| Upto Rs. 7,500 (Male) | Nil |

| Upto Rs. 10,000 (Female) | Nil |

| More than 7,500 but less than Rs.10,000 (Male) | INR 175 Per Month |

| More than Rs. 10,000 (Both Male & Female) | INR 2500 Per annum |

How to register for the tax in Maharashtra?

To register for the tax in Maharashtra follow these simple steps:

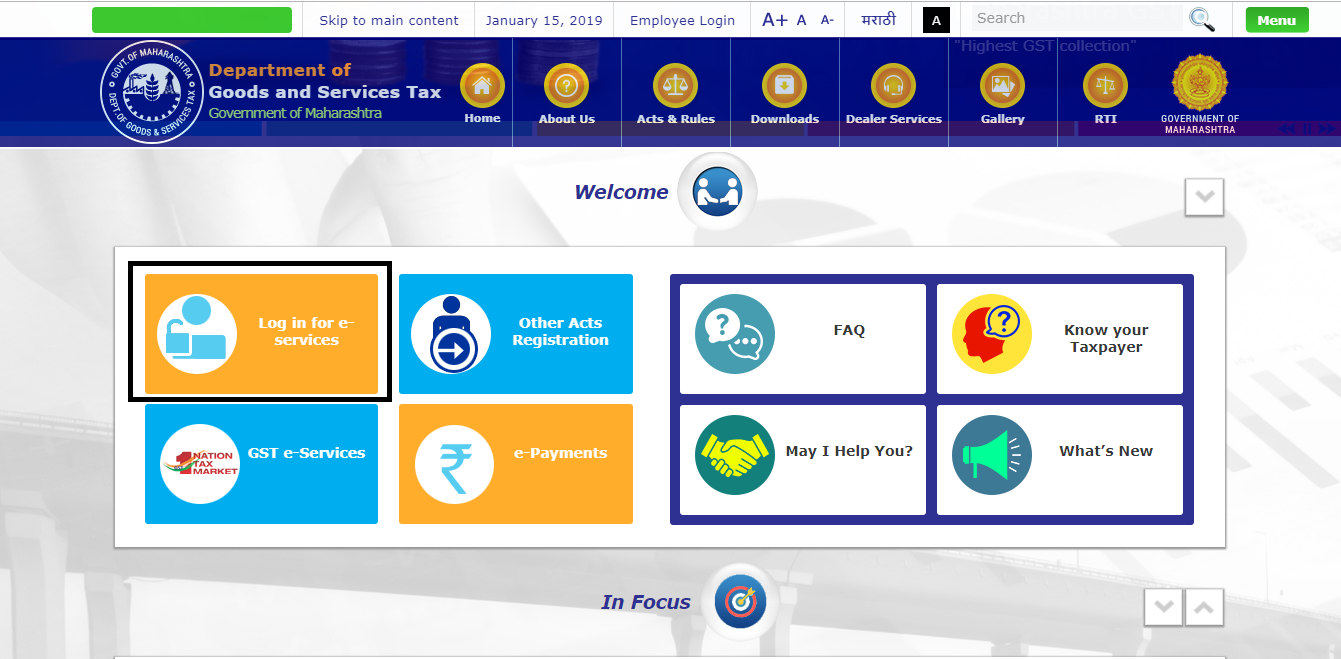

Step 1: Open government website

Firstly, open the website of the Department of Goods and Tax, Maharashtra.

Step 2: Select ‘Login for e-Services’

Secondly, under the ‘Login for e-Services’ option, click on ‘VAT and allied acts’.

Step 3: Log in to your profile

Thirdly, click on ‘Registered active dealer’ and fill in details like PAN and TIN to login to your temporary profile.

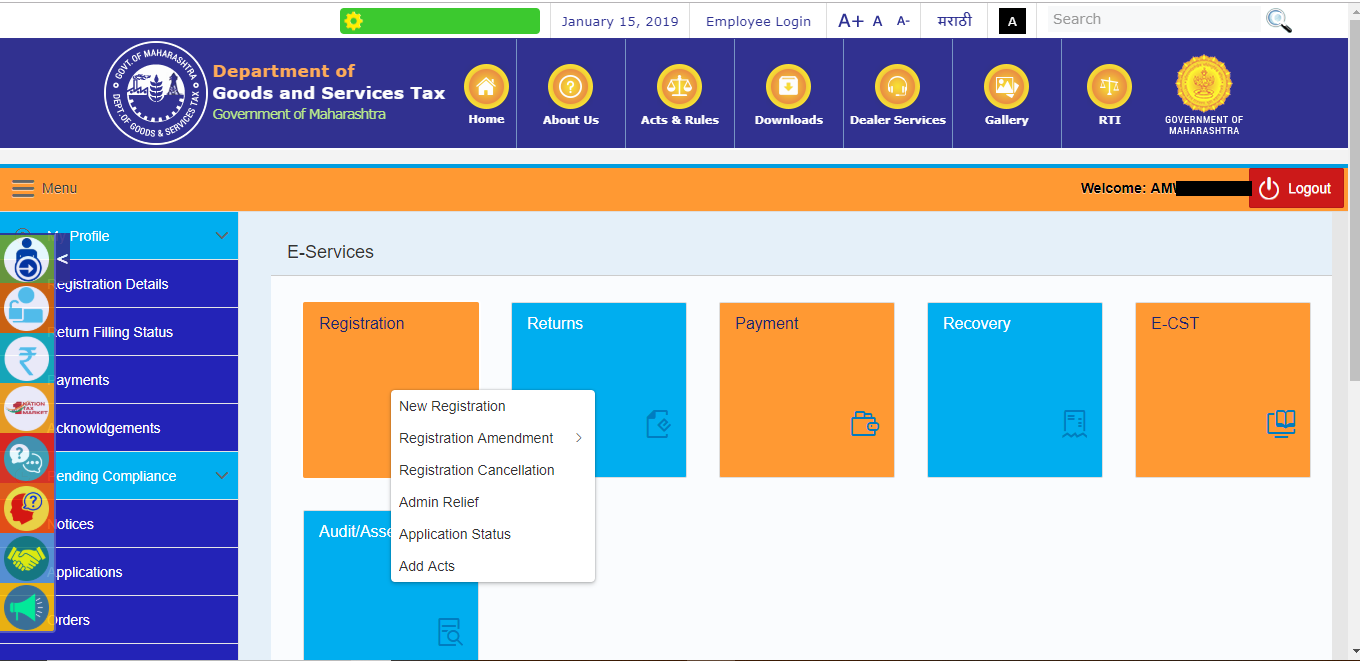

Step 4: Select ‘New Registration’

As the site redirects you to a new page, click on the ‘New Registration’ option under ‘Registration’.

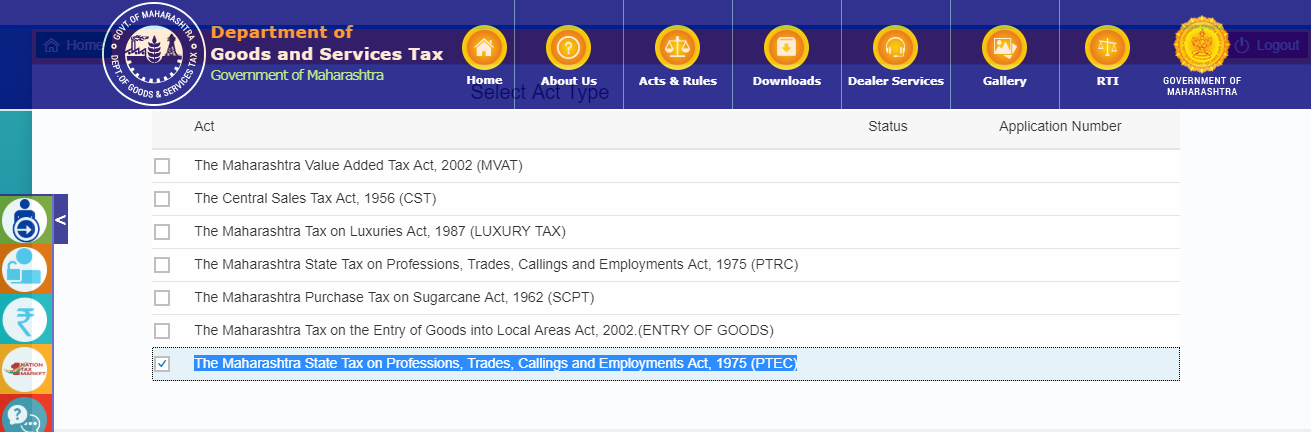

Step 5: Select the act

After that, you have to select the act which governs professional tax in Maharashtra. In this case, it will be The Maharashtra State Tax on Profession, Trades, Callings, and Employments Act, 1975 (PTEC). Now click on ‘Next’.

Step 6: Fill details for Form II

When you select the act, you will be able to see Form II. Here you need to fill details of registration, personal details, and bank details. Also, provide entry and sub-entry numbers by your category. After that, click on ‘Next’.

Note- In order to find your category, click on Annexure I.

Step 7: Make self-declaration

Now you have to validate all your details by checking the declaration box.

Step 8: Upload documents

Finally, you have to upload a scanned copy of all your documents as proof. When you are done, complete the registration by clicking on ‘Next’.

How is PT calculated in Maharashtra?

It is very simple to calculate professional tax in Maharashtra. It is so because there are no percentages involved. Hence, you just need to pay the amount which corresponds to the income slab you fall under. Moreover, if an employer owns multiple firms, he needs to pay the tax only once. Similarly, if employees run any business or practice of their own besides their jobs, they are not required to pay professional tax for those. So, paying the tax just once, or for just one area of work, is sufficient.

What is the due date for PT in Maharashtra?

If an employer does not have any employees, he is required to pay a professional tax of INR 2500 annually. However, if an employer has employees the payment is to be made monthly and following the tax slabs. Moreover, such payment is to be made within the 20th of every month. But, if an employer’s total annual professional tax liability recedes INR 1,00,000, he can pay the tax yearly.

How to pay professional tax online in Maharashtra?

In order to make an e-payment for professional tax in Maharashtra, follow these guidelines:-

Step 1: Open website

Firstly, open the GST Department website of the Maharashtra Government, on your browser. Then click on ‘e-Payments’ and select the option which matches your profession. After that, click on ‘Next’.

Step 2: Fill PAN details

Secondly, you need to fill in PAN, TAN, and/or TIN details along with the captcha.

Step 3: Select the act

Thirdly, you need to select the act under which you want to make your payment. In this case, it will be either PTEC or PTRC Act.

Step 4: Enter details

Fourthly, fill details such as financial year, duration of tax payment, location, amount, contact number, etc. After that, click on ‘Proceed to Payment’.

Step 5: Make payment

Finally, you can make the payment. In order to do this, you can choose from net banking, debit card, credit card, etc. The completion of payment will generate an acknowledgment receipt. Further, you can choose to download it for future reference.

How to file returns in Maharashtra?

Similar to the payment of professional tax, returns for the same can also be filed at the Maharashtra government’s website. In order to file the return, you need to fill Form III-B, which is available on the said website. In the case of annual returns, the period is from March to February. On the other hand, for monthly returns, the return is to be within a month of the contribution month.

What is the penalty for the late filing of professional tax in Maharashtra?

If you fail to pay the tax on time, the Maharashtra State government will levy interest of 1.25% per month, on the amount of tax to be paid. Although, if a person fails to make the payment without any reasonable cause within the time frame as mentioned in the notice served to him, he will be given a chance to be heard. If his hearing is not satisfactory, the State authority can levy a 10% penalty on the amount of tax due.

Telangana Professional Tax (PT)

What are the PT slabs in Telangana?

Find below the professional tax slabs in the state of Telangana:-

| Gross Monthly Salary | Monthly Tax Payable |

| Up to INR 15000 | Nil |

| From INR 15,000 to Rs.20,000 | INR 150 |

| Above INR 20,000 | INR 200 |

How to register for the tax in Telangana?

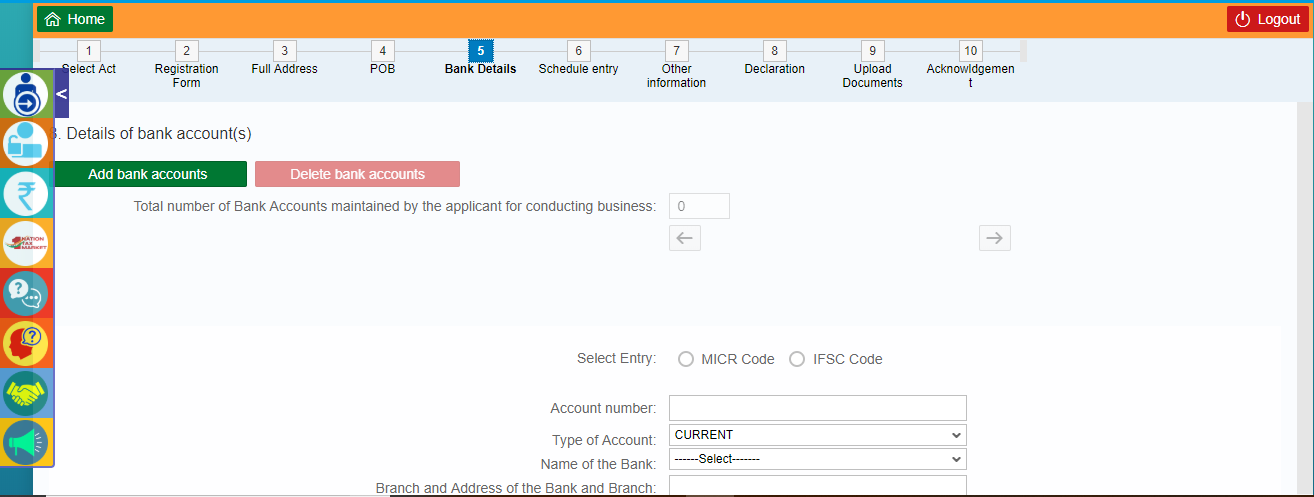

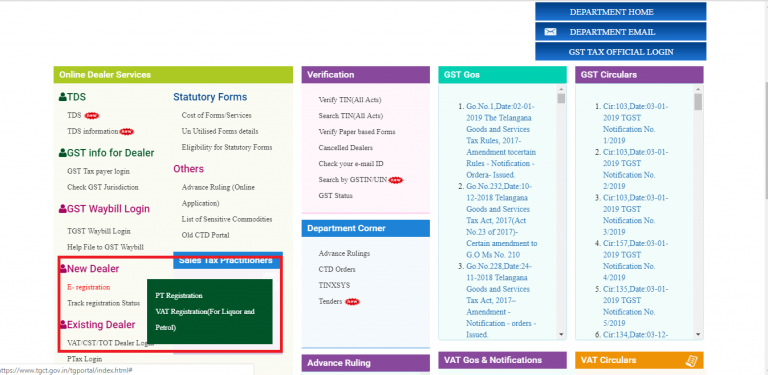

The process for online registration for professional tax in Telangana is a bit lengthy, but it is a fairly simple process. The following steps will help you register for professional tax in Telangana:-

Step 1: Open portal

Firstly, you have to open the official website of the Commercial Tax Department of the Telangana government. Now in the left panel, click on E-registration’ under the head ‘New Dealer’. Next, click on ‘PT Registration’.

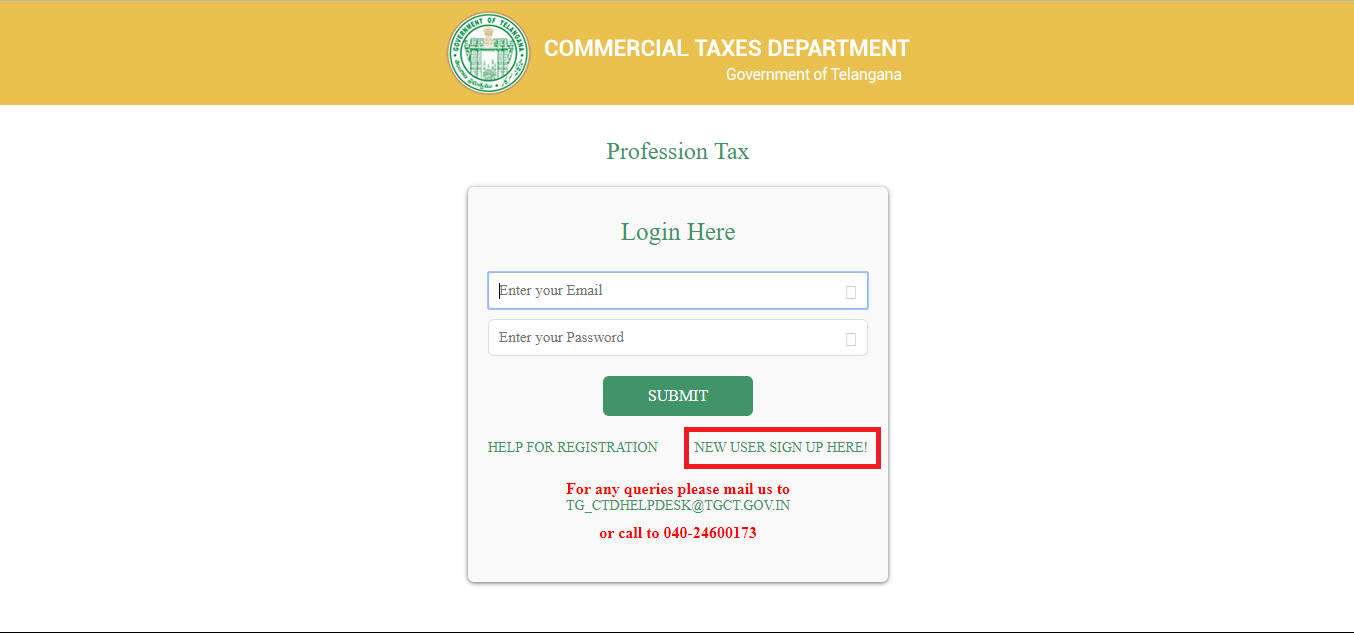

Step 2: Log in

Secondly, you have to log in to your profile. If you are new here, ‘New User Sign up here!’ After creating a new profile through your email, click on ‘New Registration’. If you have a registered account with the commercial tax department of Telangana, then just click on the VAT/ET/LT option. Now you need to fill your TIN details. Although, if you are a first-timer, you need to provide details like the name and address of your company, PAN and TAN number, etc. After that click on ‘Next’. Thereafter, you will get a reference number for future use.

Step 3: Fill details of your enterprise

Thirdly, provide the name of the director/owner/partners of your company. Select “Yes” or “No” under the authorized person as applicable. Next, enter bank details, and locations of all branches of your enterprise. At last, check the details again and click on ‘Finish’.

How is PT calculated in Telangana?

Calculating the tax in Telangana is a fairly simple process. You just need to go by the tax slab and pay the amount which corresponds to the given income you are paying the tax on.

What is the due date for payment of PT in Telangana?

The due date for payment of monthly professional tax in Telangana is the 10th of every month.

How to pay professional tax online in Telangana?

Follow the given steps to pay the tax in Telangana:-

Step 1: Open portal

Firstly, you have to open the official website of Telangana Commercial Taxes.

Step 2: Select e-Payment

Secondly, you have to select the ‘e-Payments’ option from the menu.

Step 3: Select the type of tax

Thirdly, you will get a drop-down menu. Here, click on ‘Select the Tax Type’ and choose professional tax.

Step 4: Fill details

Fourthly, you need to fill details relating to your company’s professional tax. When you are done, click on ‘Submit’.

Step 5: Make Payment

Next, you need to verify your details. Finally, make payment through net banking, debit card, credit card, etc.

How to file a return in Telangana?

As per the Professional Tax Act, all individuals registered under it, have to file a return for the tax via Form V. Further, you need to submit the return every month to an assessing authority. Additionally, the return should enclose salaries and tax deducted. Thereafter, you can file the return through treasury challan, demand draft, cheque, net banking, etc. The due date for said return is before the 10th of every month.

What is the penalty for the late filing of professional tax in Telangana?

On failure to pay the tax, the Telangana State government can levy a penalty ranging from 25% to 50% of the amount payable.

West Bengal Professional Tax (PT)

What is the rate of PT in West Bengal?

The following are the rates of professional tax in West Bengal:-

| Gross Monthly Salary (in INR) | Monthly Tax Payable (in INR) |

| 40,001 and above | 200 |

| 25,001 to 40,000 | 150 |

| 15,001 to 25,000 | 130 |

| 10,001 to 15,000 | 110 |

| Up to 10,000 | Nil |

How can I get a registration certificate in West Bengal?

Every employer in West Bengal has to acquire a Certificate of Registration in order to deduct professional tax from their employees. Hence, you have to register for the tax within 90 days from the date of tax liability. If an employer has several work locations, and parts or all of them fall under different authorities, he needs separate registration applications as well. Although, the Commissioner of Profession Tax may allow a single registration for all, provided all such locations are in West Bengal.

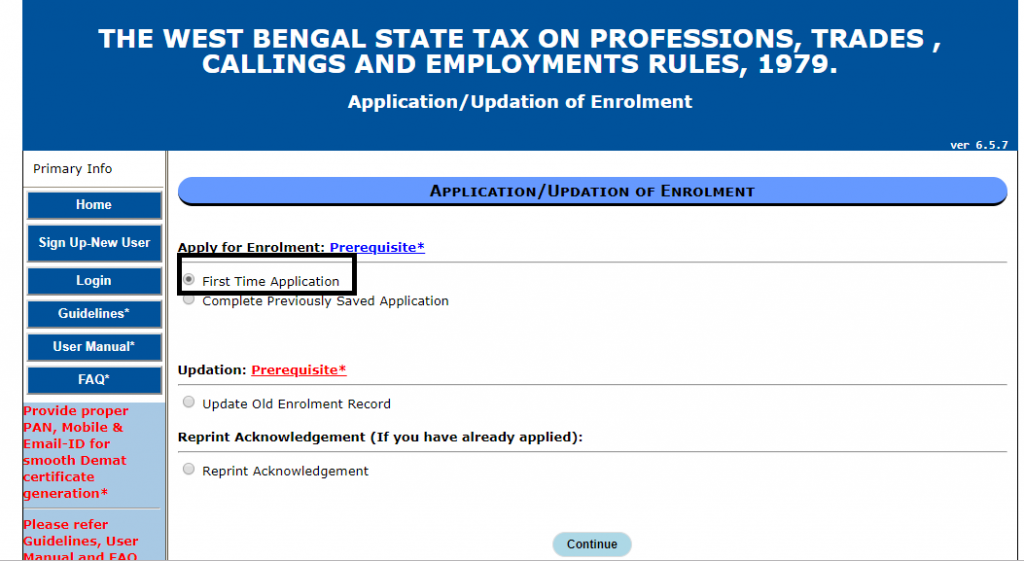

In order to register online for professional tax in West Bengal, follow these steps-

Step 1: Open official website

Firstly, you have to log in to West Bengal Government’s official website for Profession Tax. Next, click on ‘Registration’ under ‘e-Services’. After that, click on ‘First Time Application’.

Step 2: Fill details

Secondly, enter the EC (Enrollment Certificate) number. Side by side, you also have to fill contact details and PAN number.

Step 3: Verify credentials

Thirdly, you may choose to verify the credentials that you input.

Step 4: Select designation

Finally, select your designation in the company you work for. You can choose this from a drop-down menu. After that, your registration will be complete.

How is PT calculated in salary in West Bengal?

Similar to other states in India, the calculation of the tax in West Bengal is not complicated. Therefore, you just need to deduct the amount mentioned as a professional tax according to the tax slabs mentioned above. Moreover, this amount is to be deducted from the total income of an employee.

What is the due date for payment of PT in West Bengal?

To begin with, the due date for the monthly payment of the tax in West Bengal is the 21st of each month. Whereas, for yearly payment, it is 31st July of each financial year.

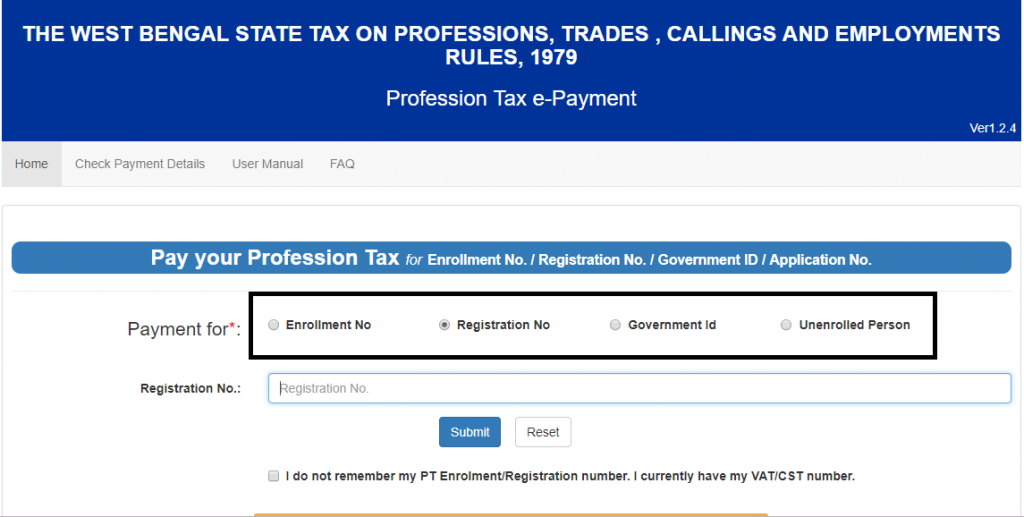

How to pay WB professional tax online?

Follow these simple steps to make the payment in West Bengal:-

Step 1: Log in to the website

Firstly, you need to log in to the West Bengal Government’s official tax website. After that, click on the ‘e-Payment’ option.

Step 2: Choose application options

Secondly, you need to choose what you are paying for. You will see the applicable options on the screen.

Step 3: Fill details

Thirdly, you need to fill details of EC, PAN, and more.

Step 4: Make payment

Finally, you can make an online payment for the tax through net banking, or debit or credit cards.

How to file a return in West Bengal?

Every registered employer in West Bengal has to file returns for the tax. Thereafter, you have to file the return electronically through the PT_Return module. Further, you have to furnish the hard copy of the return, and tax paid challan within 15 days of the next month. Moreover, in West Bengal tax returns are annual.

What is the interest on the late payment of professional tax in West Bengal?

In case of late payment of the tax, the West Bengal State government levies an interest rate of 12% per annum, on the total yearly amount payable. If the tax liability is within INR 30,000, then the late fee is INR 200. On the other hand, if the liability exceeds INR 30,000, then the State charges a penalty of INR 100 for each month the payment gets delayed.

What are PTEC and PTRC?

PTEC stands for Professional Tax Enrollment Certificate, whole PTRC is an abbreviation for Professional Tax Registration Certificate. Both of these are essential for Indian enterprises.

What is PTEC?

PTEC regulates professional taxes payable by a company and its director. Moreover, professionals, contract workers, and other non-salaried individuals also need to acquire this certificate. Further, the time limit to pay PTEC is within a month from the date of enrollment, for the first payment. Later, it is due on the 30th of June every year.

What is PTRC?

PTRC, on the other hand, regulates the professional taxes of all employees in an organization. With the help of this certificate, an employer holds the authority to deduct the tax from his salaried employees. Further, All registered employees under PTRC, have to file a return in Form III-B. Moreover, the tax liability of an employee for the previous year (or part thereof) may be less than INR 5000. Thereafter, the due date for the annual return is 31st March for such cases. Whereas, if the tax liability exceeds INR 5000, the monthly return deadline is the last date of the respective months.

Registration process

Registration processes for both the certificates usually follow the same guidelines. Although, the process itself may differ from one state to another.

The most commonly followed, basic procedure for registering to PTEC and PTRC is the following 3 steps:

Step 1: Submit the form

As the first step, upload the forms for PTEC and PTRC to the website

Step 2: Download confirmation

Following that, you will get a confirmation for the same. Then download said confirmation.

Step 3: Submit confirmation

Thirdly, submit the confirmation. This is to be paired with more documents. These documents include details, proof, and/or copy of PAN, location of the company, residential of directors, etc.

PTEC and PTRC can be registered via the same form simultaneously. The deadline to apply for enrollment is till 30 days since the inception of the company, profession, trade, etc.

Who is liable?

The enrollment of PTEC falls upon an individual registered under the MGST Act. This is per the amendments made in Profession Tax Act, 1975. Besides, if an employee’s salary exceeds INR 7500 per annum, he is liable to obtain PTRC.

What is RC and EC number in Professional Tax (PT)?

RC and EC refer to Certificate of Registration and Certificate of Enrollment, respectively. Hence, the RC and EC numbers are unique numbers that are allotted by the State government. Moreover, these numbers are allotted to anyone applying for PTRC or PTEC. Additionally, filing for GST needs requires these numbers.

Wrap-up

As a generic rule, Professional Tax (PT) is to be paid by all earning individuals. It is an indirect, State-induced tax. The definition of salary as per professional tax includes all income based on payroll, the practice of a profession, freelancing, wages, contracts, and trades, among others. In the case of a salaried employee, the employer is supposed to collect the tax and pay it to the State. In this article, you will find all you need to know about the tax in Karnataka, Maharashtra, Telangana, and West Bengal. Also, you will get an insight into the certificates to acquire concerning the tax. Besides, this blog lets you know about PTEC and PTRC. Moreover, there are some generic steps for online registration of said certificates. So, say hello to the new professional tax expert in you.

FAQs

The tax slabs vary across all the states in India. Although, the amount of annual payment cannot exceed INR 2500.

While certain states are liable to pay the tax, others are not. Although, it is mandatory for the states which are liable to pay the tax.

The tax is applicable to the following states and union territories-

Andhra Pradesh, Assam, Bihar, Chhattisgarh, Gujarat, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Manipur, Mizoram, Meghalaya, Nagaland, Odisha, Puducherry, Punjab, Sikkim, Tamil Nadu, Telangana, Tripura, Uttar Pradesh, and West Bengal.

The following states and union territories are excluded from this tax’s liability:-

Andaman and Nicobar Islands, Arunachal Pradesh, Chandigarh, Dadra and Nagar Haveli, Daman & Diu, Delhi, Goa, Haryana, Himachal Pradesh, Jammu & Kashmir, Lakshadweep, Punjab, Rajasthan, Uttarakhand and

Uttar Pradesh.

This tax is a monthly deduction from one’s income. Since it is based on the profession or job actually carried out by the individual, such tax is not refundable.

According to Professional Tax Rules, the following sections of the Indian population are exempted from paying the tax-

1. Parents of children with a permanent disability or mental disability.

2. Members of the forces as defined in the Army Act, 1950, the Air Force Act, 1950, and the Navy Act, 1957 including members of auxiliary forces or reservists, serving in the state.

3. Badli workers in the textile industry.

4. An individual suffering from a permanent physical disability (including blindness).

5. Women exclusively engaged as agents under the Mahila Pradhan Kshetriya Bachat Yojana or Director of Small Savings.

6. Parents or guardians of individuals suffering from a mental disability.

7. Individuals, above 65 years of age.

If the priorly set periodicity of a taxpayer is annual, and his tax liability recedes INR 50,000 as of the previous year, then he can change his PTRC’s periodicity to monthly. On the other hand, if his periodicity has been monthly, under the same conditions he can change the PTRC to an annual periodicity. But, if the taxpayer has made a shift in periodicity from annual to monthly, and has already filed a return, then he will not be able to change the periodicity back.

While the Central government levies TDS, it is the State government that imposes the professional tax. Additionally, TDS is applicable throughout the entire nation. On the other hand, certain states and union territories are exempted from paying professional tax. TDS is like an advanced tax, whereas professional tax is an indirect tax. Moreover, only salaried employees are liable to pay TDS. But, anyone earning an income, be it an employee or a professional practitioner or a freelancer, has to pay the tax.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.