Are you a business owner in the US looking to expand your operations in India? Wondering as to how to hire and eventually pay contractors in India? Well, to answer all your concerns, this blog is here to walk you through the entire process of hiring and paying contractors in India.

In our blog, we explore why India is a hot destination for hiring top-notch contractors, and explain the legal and regulatory framework for hiring independent contractors. It’s time to take your business to the next level by recruiting exceptional talent from India. Without further ado, let’s get going!

Contents

- Who is an Independent Contractor in India?

- Types of Independent Contractors in India

- Why is India a Top Destination to Hire and Pay Contractors in India?

- How is an Independent Contractor in India Different From an Employee?

- Penalties for Contractor and Employee Misclassification in India

- What are the Tests to Ascertain Worker Misclassification in India?

- What are the Labor Laws in India?

- What are the Laws Governing Contractors in India?

- What You Need to About Gig Workers in India?

- Steps to Hire and Pay a Contractor in India

- How to Draw Up an Independent Contractor Agreement in India

- Do’s and Don’ts of Designing an Independent Contractor Agreement to Hire and Pay Contractors in India

- How Payroll Works When You Move Ahead to Pay Contractors in India

- Tax Filing Requirements for Contractors in India

- Tax Compliance for US-based Companies

- Minimum Wages to Pay Contractors in India

- What are the Legal Issues You Need to Know Before Paying Contractors in India?

- Best Ways to Pay Contractors in India

- Things to Consider When Choosing a Global Contractor Payroll Tool

- Currency and Other Considerations to Pay Contractors in India

- Termination or Extension Terms for Independent Contractors in India

- How to Convert an Independent Contractor in India to an Employee?

- Turn to Asanify to Hire and Pay Contractors in India

- Frequently Asked Questions

Who is an Independent Contractor in India?

In India, an independent contractor is an individual or entity that provides services to another party under a contractual agreement. Unlike employees, independent contractors are not considered regular staff members and typically work on a project or task basis. They have more autonomy over their work, deciding when, where, and how to complete their tasks, without direct supervision.

The Contract Labor (Regulation and Abolition Act) 1970 oversees contract employment in India. As per this act, there is a fine line differentiating contract labor and contractor. Let’s find out the distinction:

|

Contract Labour |

Contractor |

|

An individual is said to be employed as “contract labour” if they have been hired by an establishment or another contractor to complete a certain work, “with or without the knowledge of the principal employer.” |

A contractor is a person, who is related to an establishment, that employs more than 20 workers on a contractual basis. Such a workman is hired to “produce a given result for the establishment” and not necessarily limited to “a mere supply of goods or articles” for the establishment. |

Do you know?

Unlike employees, contract workers have the liberty to work on multiple projects and may have more than one employer.

Being responsible for managing their own taxes, insurance, and other business-related expenses also forms another crucial aspect of independent contractors. They may work for multiple clients simultaneously, highlighting their independence and flexibility.

The contractual agreement between the independent contractor and the client outlines the scope of work, payment terms, and other relevant details. It’s crucial for both parties to clearly define the nature of the engagement to avoid misclassification issues, as the distinction between employees and independent contractors has legal and tax implications in India.

Types of Independent Contractors in India

Before you move ahead to hire an Indian contractor, let’s have a look at the types of independent contractors identified by law in India.

1. Temporary & Fixed-term Workers

Employees in an establishment, who are not permanent, are known as temporary and fixed-term workers. This is because they are working on a fixed-term contract. All provisions of the Indian labor law are applicable to them.

2. Gig & Platform Workers

Even if you would go back a few years across the timeline, you won’t find so many gig workers populating the work domain as much as you can notice it in the present day. Gig or platform workers have evolved to be a new worker category under The Code on Social Security, 2020. The general sense is that the work nature of the gig workers is of a shorter tenure as compared to that of the independent contractors. However, this doesn’t imply that you can’t recruit gig workers to complete longer projects. They are suitable to carry out diverse kinds of projects.

Gig workers carry out jobs that are not confined to the usual employer-employee relationship. The role that they perform might be hourly or temporary. On the other hand, platform workers are engaged with establishments offering online services to consumers via an app. For instance, Uber drivers and food delivery partners of Zomato and Swiggy fall under the category of platform workers.

Let’s have a look at certain statutes concerning gig workers:

- As per the law, it is mandatory for a gig worker to make contributions to the Social Security Program in India.

- Contributions form 1%-2% of the annual income of gig workers.

Why is India a Top Destination to Hire and Pay Contractors in India?

Thanks to the sheer globalization of the business world, companies all over the world seek to hire exceptional independent contractors owing to their in-depth niche skills and flexibility. India has emerged as a sought-after nation among individual clients or companies when things come to recruit top-notch freelancers. So, what are the reasons for the huge craze behind hiring talent from India for a specific project? Well, these include:

- Access to a vast network of outstanding contractors possessing great skills in diverse domains;

- Competitive contractor rates;

- Conducive environment for doing business

No matter what skills you need for your business, Indian independent contractors possess it all. Starting from graphic designing, content writing, client servicing to software development, India has a vast pool of talented individuals who are competent to bring great value to the businesses that hire them. As a result, Indian independent contractors are always in demand among hiring entities.

Let Asanify take the gruelling stress of independent contractor recruitment, and payroll management. Simplify overseas contractors from India hiring with Asanify’s user-friendly platform of Global Contractor Hiring!

How is an Independent Contractor in India Different From an Employee?

Independent Contractor

Employee

Penalties for Contractor and Employee Misclassification in India

In India, the penalties for worker misclassification can vary based on the nature and severity of the violation. If an employer misclassifies workers as independent contractors when they should be classified as employees and vice-versa, it may lead to legal consequences. Some potential penalties include:

1. Back Wages and Benefits

Misclassified workers may be entitled to back wages and benefits that they would have received if properly classified. This can include unpaid salaries, bonuses, and other benefits.

2. Statutory Dues

Employers may be required to pay statutory dues such as provident fund contributions, employee state insurance, and other social security contributions for misclassified workers.

3. Penalties under Labor Laws

Violations of labor laws can result in penalties imposed by relevant authorities. The amount may depend on the specific labor law breached and the extent of the violation.

4. Legal Proceedings

Misclassified workers or labor unions may initiate legal proceedings against employers, seeking compensation for the misclassification and any resultant losses.

5. Contractual Liability

Employers may be held liable for breaching employment contracts or agreements if misclassification leads to a violation of contractual terms.

6. Tax Implications

Misclassification can have tax implications for both employers and workers. Employers may face penalties for failing to withhold and remit taxes properly.

7. Administrative Actions

Government authorities responsible for labor regulation may take administrative actions against employers, including warnings, fines, or suspension of certain business activities.

8. Civil and Criminal Liability

In severe cases of intentional misclassification, employers may face civil and even criminal liabilities, with potential fines or imprisonment.

It’s essential for employers to adhere to the applicable labor laws and regulations to avoid these penalties and ensure fair treatment of workers. The specific penalties can vary across states and regions in India, so consulting with legal professionals or labor experts is advisable for precise guidance.

Suggested Read: Hire Employees in India Through EOR

What are the Tests to Ascertain Worker Misclassification in India?

In India, the control test and integration test are crucial factors used by courts to determine worker classification, especially in cases related to employment or labor disputes.

1. Control Test

This test assesses the degree of control that an employer exercises over a worker. If an employer has significant control over how, when, and where a person works, it indicates an employer-employee relationship. Factors considered in the control test include the employer’s authority to set work hours, provide tools or equipment, and dictate the specific tasks to be performed by the worker.

2. Integration Test

The integration test evaluates how integral the worker is to the employer’s business. If the worker is an integral part of the employer’s operations, it strengthens the case for an employer-employee relationship. Key aspects considered in the integration test involve assessing whether the worker’s role is vital to the core functions of the business and whether the worker is economically dependent on the employer.

Apart from the above-mentioned tests, the Supreme Court of India uses the following questions to ascertain the classification of workers:

- Who is paying the worker for the services rendered?

- What is the tenure of the service delivered by the worker?

- Who has the right to appoint and dismiss the worker?

- What is the job role and extent of supervision involved?

- Is there any provision of required equipment?

…and, so on.

These tests are essential for determining whether a worker should be classified as an employee or an independent contractor. The distinction is significant as it affects various rights and benefits, such as minimum wages, social security contributions, and other labor protections.

Also Read: Employee Misclassification Guide

What are the Labor Laws in India?

India’s labor laws cover a wide range of aspects related to hiring employees and contractors. These include:

Hiring Employees

1. Employment Contracts

- Employment contracts are typically required and should outline terms and conditions, such as salary, working hours, benefits, and termination clauses.

- Fixed-term contracts and probationary periods are common, but certain rights are protected regardless of the contract type.

2. Working Hours

- The standard working week is 48 hours, and employees are entitled to overtime pay for exceeding this limit.

- Specific rules may vary across states.

3. Minimum Wage

- Minimum wage rates are set by both the central and state governments.

- Rates can vary based on the type of employment, skill level, and location.

4. Leave Entitlements

- Employees are entitled to annual leave, sick leave, and public holidays.

- Maternity leave provisions are also in place.

5. Social Security

Provident Fund (PF) and Employee State Insurance (ESI) are mandatory social security contributions for certain categories of employees.

6. Termination

- Termination procedures are regulated, and notice periods or severance pay may be required.

- Unfair dismissal laws protect employees against arbitrary termination.

Hiring Contractors

1. Contractual Agreements

- Clear written contracts specifying the scope of work, deliverables, and payment terms are crucial.

- Different rules may apply for independent contractors and those engaged through labor contracts.

2. Taxation

- Contractors are responsible for their own taxes and benefits.

- The tax treatment of contractors may differ from that of employees.

3. Labour Contract Laws

The Contract Labour (Regulation and Abolition) Act applies when employing contract labor.

4. Liability

- Principal employers are often liable for ensuring labor law compliance by contractors.

- Due diligence is necessary to avoid legal issues related to outsourcing.

Compliance and Regulatory Authorities

1. Compliance

- Employers must adhere to various central and state labor laws and regulations.

- Regular audits and compliance checks are essential.

2. Regulatory Authorities

- The Ministry of Labour and Employment at the central level and state labor departments oversee labor laws.

- Various Acts, such as the Industrial Disputes Act, Shops and Establishments Act, and others, regulate specific aspects of employment.

It’s crucial to stay informed about any changes in labor laws and seek legal advice to ensure compliance with the latest regulations.

Recommended Read: Pay Contractors in Sweden- A Comprehensive Guide to Hiring

What are the Laws Governing Contractors in India?

To prevent worker misclassification, it is crucial to stay aware of the various laws governing the rights of contractors in India. Let’s have a look at the major statutes!

1. Contract Labour (Regulation and Abolition) Act, 1970

Regulates the employment of contract labor and ensures that their rights don’t get violated.

2. Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996

Provides for the safety, health, and welfare of construction workers, including those employed by contractors.

3. The Registration Act, 1908

Governs the registration of various documents, including contracts, to make them legally valid.

4. Indian Contract Act, 1872

Covers the general principles of contract law, including formation, performance, and breach of contracts.

5. Goods and Services Tax (GST)

Applicable for contractors providing goods or services, and compliance with GST regulations is essential.

6. Income Tax Act, 1961

Contractors are subject to income tax regulations, and their income is taxed accordingly.

It’s crucial to note that these laws are subject to amendments, and compliance requirements may vary based on the nature of the contract and the region within India. Always seek professional advice for the latest and accurate information.

Suggested Read: Pay Contractors in Poland- A Complete Hiring Manual

Steps to Hire and Pay a Contractor in India

Hiring a contractor in India involves several steps. These include:

1. Define Your Project Scope

- Clearly outline your project requirements, including the scope, timeline, and budget.

- Specify materials, designs, and any other relevant details.

2. Research Contractors

- Seek recommendations from friends, colleagues, or online platforms.

- Check online reviews and ratings for potential contractors.

- Verify the contractor’s credentials, licenses, and experience.

3. Shortlist Contractors

Narrow down your list based on reviews, qualifications, and compatibility with your project.

4. Request Bids

- Contact shortlisted contractors and request detailed bids.

- Ensure the bids include a breakdown of costs, project timeline, and payment schedule.

5. Check References

- Ask contractors for references from their previous clients.

- Contact these references to gain insights into the contractor’s reliability and quality of work.

6. Verify Licenses and Insurance

- Ensure the contractor holds the necessary licenses and certifications for your specific project.

- Confirm that the contractor has insurance to cover potential accidents or damages.

7. Negotiate Terms and Sign a Contract

- Discuss terms, including payment schedules, milestones, and penalties for delays.

- Draft a comprehensive contract outlining all agreed-upon terms and have it signed by both parties.

8. Secure Permits

Identify and obtain any necessary permits for your project from local authorities.

9. Monitor Progress

- Regularly inspect the work to ensure it aligns with your expectations.

- Communicate openly with the contractor and address any concerns promptly.

10. Payment

- Adhere to the agreed-upon payment schedule outlined in the contract.

- Keep records of all transactions.

11. Completion and Inspection

- Once the project is completed, conduct a final inspection.

- Ensure that all aspects of the project meet your satisfaction before making the final payment.

12. Closeout

- Obtain all necessary documentation, warranties, and receipts from the contractor.

- Close out the project officially and express satisfaction or concerns to the contractor.

Also Read: Invoice for Contractors

How to Draw Up an Independent Contractor Agreement in India?

Drawing up an independent contractor agreement in India involves careful consideration of legal and practical aspects. The most crucial particulars that you need to include in the agreement include:

1. Title and Introduction

- Start with a clear title identifying it as an “Independent Contractor Agreement.”

- Include the names and addresses of both parties.

2. Recitals

- Provide a brief background or purpose of the agreement.

- Outline the nature of the services to be provided by the contractor.

3. Definitions

Clearly define terms used in the agreement to avoid ambiguity.

4. Scope of Work

- Detail the specific services the contractor will provide.

- Include deliverables, timelines, and any performance metrics.

5. Term and Termination

- Specify the start and end dates of the contract.

- Outline conditions and notice periods for termination.

6. Payment Terms

- Clearly state the compensation structure, including rates and frequency.

- Mention any taxes, deductions, or reimbursements applicable.

7. Expenses

- Specify whether the contractor will be reimbursed for reasonable expenses.

- Clearly outline the process for submitting and approving expenses.

8. Intellectual Property Rights

- Define ownership of any intellectual property created during the contract.

- Include confidentiality and non-disclosure clauses.

9. Confidentiality

- Emphasize the importance of maintaining confidentiality.

- Specify the handling of sensitive information during and after the contract.

10. Insurance

- Define the insurance coverage required, if any.

- Clearly state who is responsible for insurance costs.

11. Independent Contractor Status

- Explicitly state that the contractor is an independent contractor, not an employee.

- Clarify the contractor’s responsibility for taxes and benefits.

12. Dispute Resolution

- Specify the mechanism for resolving disputes, such as arbitration or mediation.

- Outline the governing law.

13. Indemnification

- Clarify the responsibilities of each party in case of legal claims.

- Define indemnification provisions.

14. Force Majeure

Include a force majeure clause to address unforeseen events beyond the parties’ control.

15. Notices

Specify how and where formal notices should be delivered.

16. Governing Law

Clearly state which laws govern the agreement. This would come to aid during the times of conflicts, if any.

17. Amendments

Include a clause outlining the process for amending the agreement.

18. Signatures

- Include spaces for signatures, names, and dates.

- Ensure that both parties sign the agreement.

19. Attachments

Attach any relevant documents, such as project specifications or additional terms.

Once drafted, it’s advisable to seek legal advice to ensure compliance with Indian laws and to customize the agreement based on the specific nature of the engagement.

Important to Know: Section 27 of the Indian Contract Act nullifies the non-compete clauses of an independent contractor agreement. Using these clauses in the US is rampant. However, several states are framing laws to restrict companies from including these clauses in the contract. Anyway, these clauses can’t be enforced in India.

Do’s and Don’ts of Designing an Independent Contractor Agreement to Hire and Pay Contractors in India

Do’s

1. Clearly Define Scope of Work

Clearly outline the tasks, responsibilities, and deliverables expected from the contractor to avoid misunderstandings.

2. Payment Terms

Specify the payment structure, including rates, frequency, and any additional expenses or reimbursements. Comply with local regulations on timely payments.

3. Term and Termination

Define the contract duration and conditions under which either party can terminate the agreement. Include notice periods and termination clauses.

4. Intellectual Property (IP) Rights

Clearly state who retains ownership of any intellectual property created during the contract. Ensure compliance with Indian laws on IP.

5. Confidentiality

Include clauses to protect sensitive information and data. Clearly outline what constitutes confidential information and the obligations of both parties.

6. Compliance with Laws

Ensure that the agreement complies with Indian labor laws, tax regulations, and any other relevant statutes. Seek legal advice to stay updated on any changes.

7. Insurance and Liabilities

Specify any insurance requirements and clarify liability for accidents, damages, or losses incurred during the contract period.

Don’ts

1. Avoid Ambiguity

Refrain from vague or ambiguous language. Clearly define terms to minimize misunderstandings and disputes.

2. Don’t Overlook Jurisdiction

Clearly specify the jurisdiction governing the contract. In India, it’s essential to mention the applicable state laws for dispute resolution.

3. Misclassification of Employment

Ensure the agreement clearly states the independent contractor relationship to prevent misclassification issues. This is crucial for tax and labor law compliance.

4. Omitting Indemnity Clause

Include an indemnity clause to protect both parties from legal actions arising from the contractor’s work, especially if it involves third-party claims.

5. Exclusivity

Avoid restricting the contractor from working with other clients, unless there’s a valid reason. Be transparent about any exclusivity requirements.

6. Incomplete Payment Information

Do not omit essential payment details, such as currency, payment methods, and tax implications. This helps in avoiding payment disputes.

7. Ignoring Dispute Resolution

Specify a dispute resolution mechanism, whether through arbitration, mediation, or litigation. Ignoring this can lead to lengthy legal battles.

Always consult with legal professionals familiar with Indian labor laws to ensure your independent contractor agreement is comprehensive and compliant.

Recommended Read: Independent Contractor Agreement for USA

How Payroll Works When You Move Ahead to Pay Contractors in India?

When processing payroll for contractors in India, there are certain key steps that you need to follow:

1. Contract Agreement

Begin by establishing a clear contract outlining the terms, deliverables, and payment details. Ensure compliance with Indian labor laws and tax regulations.

2. Tax Deductions

Contractors in India are typically subject to Tax Deducted at Source (TDS). Calculate and deduct TDS from the contractor’s payment according to the applicable rates.

3. GST Compliance

Verify the GST registration status of the contractor. If registered, ensure proper invoicing with GST details. Compliance with Goods and Services Tax (GST) regulations is crucial.

4. Payment Structure

Determine the payment frequency and structure. Common payment methods include bank transfers or checks. Therefore, it is of foremost important to maintain accurate records of payments made.

5. Record Keeping

Keep detailed records of payments, invoices, and contracts. Proper documentation is crucial for compliance and audits.

6. Currency Considerations

If you are paying in a currency other than Indian Rupees, be mindful of exchange rates and any associated fees.

Always consult with a professional accountant or legal advisor familiar with Indian payroll regulations to navigate the complexities of payroll processing for contractors effectively. To make things easier, switch to Asanify, a global contractor payroll services. All you have to do is carry out payroll run in a single click while staying fully compliant with Indian labor laws and regulations.

Suggested Read: How to Pay Contractors in Your Business? The Ultimate Guide

Tax Filing Requirements for Contractors in India

In India, it is mandatory for contractors to file their taxes on time. The e-Filing Portal by the Government of India makes filing taxes and forms simple and secure for contractors operating in India. They need to file both Income Tax Return (ITR) and Goods & Services Tax (GST).

Let’s have a look at a couple of vital guidelines regarding tax filing requirements for Indian contractors:

- For clients, who need to adhere to the TDS provisions according to the Income Tax Act, 1961, ought to deduct TDS from the fees paid for professional services at the rate of 10%- provided that the payment amount surpasses the threshold limit of INR 30,000 annually.

- Paying GST charges is a must for all independent contractors in India if their annual earnings exceeds INR 20 lakh. Invoices generated must also comply with the specifications mandated by the Indian labor laws.

Tax Compliance for US-based Companies

If you are a US company looking to hire and pay contractors in India, key tax compliance forms include:

1. W-8BEN

Contractors in India need to provide a W-8BEN form to declare their foreign status. This form helps determine the appropriate withholding tax rate.

2. Form 1042

The U.S. company may need to file Form 1042 to report withholding tax on payments made to foreign contractors.

3. Form 1042-S

This form is issued to the foreign contractor, summarizing the income paid and taxes withheld. It must be furnished to the contractor and filed with the IRS.

4. Form 1099-NEC or 1099-MISC

If payments to the Indian contractors exceed the IRS reporting threshold, the U.S. company may need to issue Form 1099-NEC for non-employee compensation or 1099-MISC for other income.

Minimum Wages to Pay Contractors in India

The Minimum Wages Act, 1948 used to regulate the minimum wages received by workers in India. However, the Code on Wages Act, 2019 now oversees this aspect, having replaced the previous act. There is no specific minimum wage rate in India because it keeps changing on the basis of state, level of development, industry, skill, and profession. Therefore, it is a good practice to offer a fair pay rate to all your contractors in India, taking into consideration their skills, experience, and other relevant parameters.

What are the Legal Issues You Need to Know Before Moving Ahead to Pay Contractors in India?

Since you will be moving ahead with the process to hire and pay contractors in India, it is crucial for you to be aware of certain legal risks that might get triggered if you are not aware of it.

1. Risk of Being Considered a Permanent Establishment

Do you conduct business operations in India frequently? If yes, your business is at the risk of being labelled as a “permanent establishment.” Upon auditing, the tax authorities may identify your business as a permanent establishment, thereby subjecting you to hefty penalties and corporate taxes. The only way to safeguard your business is by using the services of a global Employer of Record like Asanify. In that way, your business will be insulated from the onslaught of penalties.

2. Worker Misclassification

It is way too important to ensure that you classify the contractors correctly. The narrow boundary separating contractors from employees needs to be adhered to. Misclassifying contractors may cost you a lot and embroil your business in a whirlwind of legal conflicts. Therefore, insulating your business from worker misclassification charges is way too essential.

3. Protection of Intellectual Property (IP)

Since you will be working with contractors based out of a different country, it is obvious to feel a bit lost when things come to getting a grasp of the rules and regulations of the foreign country. Finding your way through getting approvals related to patent, copyright, and trademark rules at your home country might be fairly easy. However, procuring the same on an alien land may turn out to be a herculean task. In case of not being able to protect your IP rights, chances of vulnerability of your business to potential risks might emerge. So, it is important to keep this factor in mind before you move ahead to hire and pay contractors in India.

Best Ways to Pay Contractors in India

Having a proper payment platform in place is essential to ensure the safe deposition of the contractor’s remuneration in their accounts. Usually, release of payment to an overseas contractor from India occurs monthly. Anyway, it is essential to use an organized platform for paying independent contractors in India. This is crucial to ensure the generation of contractor invoicing periodically while consolidating payouts seamlessly. It is advisable to use a payroll management platform to carry out fast and secured monetary transactions. Take currency conversion rates into consideration and release payouts on time to create a healthy working relationship with your freelancers.

So, what possible options can you use to pay contractors in India? Let’s have a look at those!

In India, various payment methods are used to pay contractors, including:

1. Bank Transfers- To Pay Contractors in India

Electronic fund transfers through NEFT (National Electronic Funds Transfer) or RTGS (Real Time Gross Settlement) are common methods. This provides a secure and traceable way to transfer funds directly to the contractor’s bank account.

2. Cheques- To Pay Contractors in India

Writing a cheque is a traditional method where the contractor can deposit it into their bank account. It provides a tangible record of the transaction.

3. UPI (Unified Payments Interface)- To Pay Contractors in India

With the rise of digital payments, UPI has become popular. Payments can be made directly from a bank account to the contractor’s UPI ID.

4. Cash Payments- To Pay Contractors in India

While less common, some contractors may still prefer cash payments. However, this method lacks a clear trail and may not be recommended for larger transactions due to potential security and record-keeping issues.

5. Payment Wallets- To Pay Contractors in India

Using digital wallets like Paytm, PhonePe, or Google Pay is convenient for quick transactions. Contractors can receive payments directly into their wallet and later transfer it to their bank account. In case of PhonePe and Google Pay, contractors can receive their due payments directly in their bank accounts.

6. Payment Apps- To Pay Contractors in India

Mobile banking apps provided by various banks allow users to make payments using their smartphones. Contractors can provide their account details to receive payments through these apps.

7. Online Payment Platform- To Pay Contractors in India

Utilizing online payment platforms like PayPal or Stripe may be an option for international transactions, providing a secure and widely accepted means of payment.

8. Letter of Credit- To Pay Contractors in India

For larger projects, a letter of credit issued by a bank can be used. It ensures payment upon completion of specific milestones and provides financial security for both parties.

9. Money Orders- To Pay Contractors in India

By resorting to money orders, you can be sure that the payouts will be carried out in a safe and secure manner. The only drawback of this payment option is that it is not well-adopted to fit in the current scenario of disbursal of payments at a lightning pace. As a result, the dispatch of payouts to the independent contractors gets delayed to a great extent. This also casts an adverse impact on the project deadlines.

10. Global Contractor Payroll Services- To Pay Contractors in India

The best option to pay the Indian independent contractors is by using a global contractor payroll software. These HRMS platforms aid the companies or clients to send the compensation to the contract workers in their chosen currency. Further, using these will help you stay compliant with the provisions of the Indian labor law. As a result, it would lead to the creation of a positive and healthy work relationship with your Indian contractors. Asanify is one such platform offering the best-in-class FX rates for contractor payroll. Just fall back on Asanify and witness payroll calculation and payout consolidation being carried out in a jiffy, all thanks to its Global Contractor Hiring platform.

Suggested Read: Pay Contractors in Ukraine- A Comprehensive Guide to Hiring

Things to Consider When Choosing a Global Contractor Payroll Tool to Pay Contractors in India

Choosing a global contractor payroll tool is a critical decision that requires careful consideration of various factors to ensure compliance, efficiency, and accuracy in managing payroll processes across different countries. Here are some key things to consider:

1. Global Compliance

Tax and Legal Compliance: Ensure that the tool complies with the tax and legal regulations of each country where your contractors are located. This includes understanding local tax laws, social security contributions, and other statutory requirements.

Data Privacy: Consider data protection laws and ensure that the tool adheres to international standards for data privacy, such as GDPR (General Data Protection Regulation) in the European Union.

2. Multi-Currency and Multi-Language Support to Pay Contractors in India

Currency Conversion: Verify that the tool can handle multiple currencies to accommodate payments in local currencies for each contractor.

Language Support: The tool should support multiple languages to provide a user-friendly interface for users in different regions.

3. Integration Capabilities

Integration with HR Systems: Ensure that the payroll tool can seamlessly integrate with your existing HR systems to avoid manual data entry and reduce the risk of errors.

APIs and Third-Party Integrations: Check for the availability of APIs and compatibility with other third-party tools, such as accounting software and time tracking systems.

4. Scalability and Flexibility

Ability to Scale: Consider the tool’s scalability to accommodate your organization’s growth and changing needs as you expand into new regions.

Configurability: The tool should be flexible enough to adapt to various payroll and compliance requirements in different countries without extensive customization.

5. User-Friendly Interface

Intuitive Design: Choose a tool with an intuitive user interface that is easy to navigate, reducing the learning curve for users across different regions.

Accessibility: Ensure that the tool is accessible to users with different levels of technical expertise.

6. Reporting and Analytics

Customizable Reports: Look for a tool that provides customizable reports to meet the specific reporting needs of your organization and local authorities.

Real-time Analytics: Access to real-time analytics can help in monitoring payroll expenses, compliance, and other key metrics.

7. Customer Support and Training

24/7 Support: Consider the availability of customer support to address any issues promptly, especially when dealing with global operations in different time zones.

Training Resources: Check if the vendor provides comprehensive training resources to ensure that your team can effectively use the tool.

8. Cost and ROI

Transparent Pricing: Understand the pricing structure, including any additional fees for support, updates, or customization.

Return on Investment (ROI): Evaluate the potential return on investment by considering the time and cost savings, reduced compliance risks, and improved accuracy in payroll processing.

9. Security Measures

Data Encryption: Ensure that the tool uses robust encryption methods to protect sensitive payroll and personal information.

Compliance with Security Standards: Verify that the tool complies with industry security standards and undergoes regular security audits.

10. Vendor Reputation and Reliability

Vendor Track Record: Research the vendor’s reputation, customer reviews, and track record in providing global payroll solutions.

Financial Stability: Choose a vendor that is financially stable and likely to be a long-term partner to support ongoing payroll needs.

By carefully evaluating these factors, you can choose a global contractor payroll tool that aligns with your organization’s requirements, ensuring compliance and efficiency in managing payroll processes on a global scale.

Currency and Other Considerations to Pay Contractors in India

When paying contractors in India, it’s essential to consider the currency, tax implications, and legal aspects. The official currency in India is the Indian Rupee (INR). Ensure that your payment is in INR to comply with local regulations and avoid currency exchange issues.

1. Currency Exchange Rates

Stay updated on exchange rates to calculate the equivalent amount accurately. Fluctuations in exchange rates can impact the final payment received by the contractor.

2. Payment Methods

Common methods include wire transfers, online banking, and payment gateways. Be aware of transaction fees associated with each method and confirm the preferred method with the contractor.

3. Tax Deductions

Deduct taxes at source (TDS) as per Indian tax regulations. This is usually a percentage of the total payment. Ensure compliance with the Income Tax Act to avoid legal issues.

4. GST (Goods and Services Tax)

Understand the applicability of GST on the services provided. Contractors may need to register for GST, and the tax should be included in the invoiced amount.

By addressing these considerations, you can navigate the payment process for contractors in India smoothly while adhering to legal and financial requirements.

Termination Or Extension Terms for Independent Contractors in India

Typically, the conditions governing the termination or extension terms of an independent contractor in India depend on the terms outlined in the contract between the contractor and the client. Termination clauses may specify conditions under which either party can end the contract, such as a breach of terms or completion of the project.

Extensions are generally negotiated based on project needs, and the contract may outline procedures for extending the engagement. It’s crucial to have clear and comprehensive agreements to avoid misunderstandings and ensure a smooth working relationship. Legal advice specific to Indian employment laws is advisable when drafting such contracts.

Also, check out: Terminating a Contractor- Know How to End an Agreement Politely

How to Convert an Independent Contractor in India to an Employee?

Converting an independent contractor to an employee in India involves several steps:

1. Legal Compliance

Ensure compliance with local labor laws and regulations in India. Familiarize yourself with the specific rules regarding employment contracts, benefits, and taxes.

2. Offer of Employment

Draft a formal offer letter outlining the terms of employment, including job responsibilities, salary, benefits, and any other relevant details. Ensure clarity on the transition from contractor to employee status.

3. Contract Termination

Terminate the existing independent contractor agreement. Follow any notice periods specified in the contract and settle any outstanding payments or obligations.

4. New Employment Contract

Draft a new employment contract specifying the terms and conditions of the employment relationship. Include details such as job title, working hours, compensation, benefits, and any probationary period.

5. Statutory Requirements

Ensure compliance with statutory requirements such as Provident Fund (PF), Employee State Insurance (ESI), and Professional Tax. Register the employee for these schemes and deduct the required contributions.

6. Tax Implications

Update tax documentation to reflect the change in employment status. Deduct taxes at source according to applicable rates and rules.

7. Employee Benefits

Enroll the employee in any applicable company benefits, such as health insurance, gratuity, and any other benefits offered to full-time employees.

8. Orientation and Training

Provide an orientation program for the new employee, covering company policies, procedures, and any specific training required for the role.

9. Update Records

Update internal records and systems to reflect the change in employment status. This includes HR databases, payroll systems, and any other relevant platforms.

10. Communication

Communicate the transition to the rest of the team and relevant stakeholders. Ensure a smooth handover of responsibilities if necessary.

11. Feedback and Evaluation

Conduct regular check-ins with the employee to gather feedback and address any concerns. Perform performance evaluations as per the company’s policies.

12. Ongoing Compliance

Regularly review and update employment contracts, ensuring continued compliance with changing labor laws and regulations in India.

Recommended Read: EOR India- A Detailed Guide on Employer of Record

Turn to Asanify to Hire and Pay Contractors in India

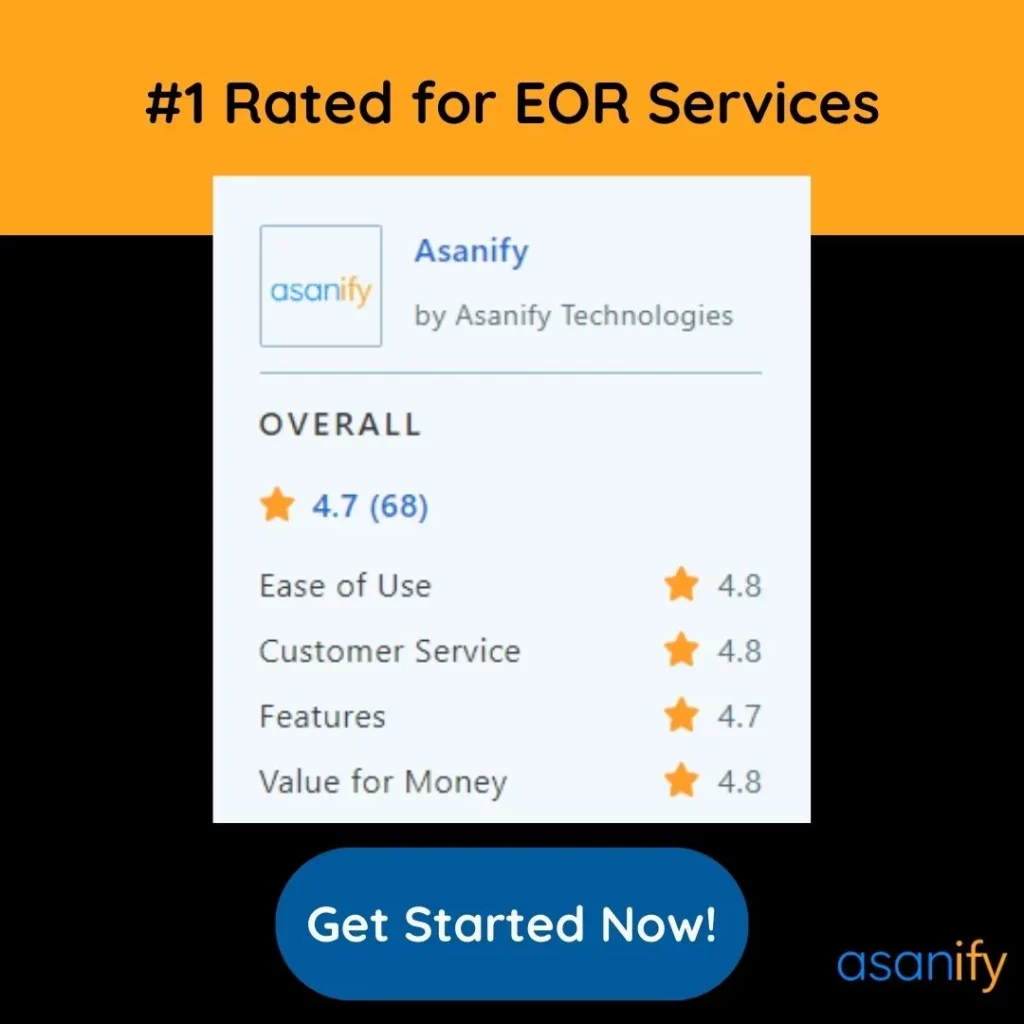

When things come to hiring and paying highly skilled contractors in India, Asanify is going to be your perfect companion in simplifying the various processes that come with it. So, what processes are we referring to? Well, these include:

- Drafting the independent contractor agreement;

- Completing the hiring and post-recruitment formalities;

- Managing contractors;

- Payroll calculation;

- Taking care of the currency conversion rates

Our vast expertise in talent recruitment will aid you in retaining the highly skilled contractors who would contribute towards taking your business to greater heights. Further, with Asanify’s Global Contractor Hiring platform, the nerve-wracking task of hiring, paying, and managing contractors will be significantly simplified.

So, what are you waiting for? Stay compliant with the local laws and de-stress by letting us generate payroll for your contractors in seconds.

To know more about Asanify, book a demo today!

Frequently Asked Questions: Pay Contractors in India

Q: How do I find reliable contractors in India?

A: Research online platforms, ask for recommendations, and check reviews to identify reputable contractors.

Q: What documents are required while moving ahead to hire and pay contractors in India?

A: Ensure you collect PAN card, Aadhaar card, and GST registration details, along with a written contract specifying terms and conditions.

Q: What factors should I consider when negotiating payment terms with a contractor?

A: Discuss project milestones, payment schedules, and ensure clarity on any additional costs to avoid misunderstandings.

Q: Are there legal requirements for hiring contractors in India?

A: Yes, it’s crucial to comply with labor laws, tax regulations, and ensure the contractor has a valid GST registration.

Q: How can I calculate the appropriate payment for a contractor’s services?

A: Consider the scope of work, industry standards, and the contractor’s experience when determining a fair and competitive payment.

Q: What payment methods are commonly used to pay contractors in India?

A: Bank transfers, cheques, and online payment platforms are commonly used. Ensure to keep records for transparency.

Q: Can I hire international contractors for projects in India?

A: Yes, it’s possible. Ensure they comply with Indian regulations, and address any legal and logistical considerations.

Q: Are there tax implications while striding ahead to hire and pay contractors in India?

A: Yes, both the client and the contractor have tax obligations. Do note that it is important to familiarize yourself with TDS (Tax Deducted at Source) and GST rules.

Q: How can I handle disputes with contractors over payments or project issues?

A: Refer to the terms outlined in your contract, attempt amicable resolution first, and if needed, seek legal advice or mediation.

Q: What are the key differences between hiring a contractor and an employee in India?

A: Contractors are typically hired for specific projects, responsible for their own taxes, and don’t receive employee benefits. Employees have a longer-term commitment and are entitled to benefits and protections.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.