Hiring employees in India is a challenging process, chiefly due to the complex legal framework, regulations of the Indian job market, and its unique social dynamics. We are here to give you all the information and best HR practices you’ll need to hire employees in India seamlessly.

Whether you are a small startup, a multinational corporation, or an international company, this is a comprehensive market discovery guide with insights into the Indian job market. By the end of this article, you’ll know whether you need to establish a legal entity or work with Employer of Record partners, and how to hire employers in India with EOR.

Contents

- Employer of Record vs Legal Entity

- Employee Classification and Indian Market Info

- How to Hire Employees in India?

- Onboarding Checklist

- Payroll, Wages, Taxes and Employee Benefits

- Work Permit

- How Asanify EOR Helps You

- Laws and Compliance Best Practices

- Protecting Company IP

- Offboarding

- Conclusion

- FAQ

Employer of Record vs Legal Entity

When expanding to India, establishing a legal entity might generally seem like the first step. But hold on! You don’t need a legal entity to start hiring employees in India.

An Employer of Record (EOR) can handle the entire hiring process, from finding talent to managing payroll, compliance, and managing employees through their entire life cycle.

Why choose an EOR?

- Local expertise: EORs have deep knowledge of Indian labor laws and regulations.

- Time and cost savings: Avoid the complexities of setting up a legal entity.

- Flexibility: Scale your operations easily without long-term commitments.

Consider a legal entity later.

Once you’ve established a strong presence and understand the market, setting up a legal entity might be beneficial. But starting with an EOR is the best way to hire employees in India as it allows you to test the waters without significant investment or risk.

We have drafted a table of comparison for EOR vs legal entity, to help you decide how you want to hire employees and remote workers in India.

Criteria | EOR [Employer of Record] | Legal Entity |

|

Set up time to start business |

Within days, as soon as paperwork is done |

Time-consuming, can take 6-9 months to set up the legal entity |

|

Managing costs |

Pay a regular amount for every person you hire |

Upfront payment for setting up the entity, incorporation and legal fees, office space, huge management fees |

|

Suitability |

Perfect choice when you are venturing into a new country and want to start your business without a lot of upfront investment |

Setting up your own legal entity makes sense when you are expanding on a large scale in a new market |

|

Compliance |

EOR partner brings local expertise in country laws, networking, cultural knowledge, and compliances.

|

The company is responsible for handling compliances – you’ll require a legal team knowledgeable in local tax, labor laws, and compliance practices |

|

Hiring |

You can hire as soon as 1 week |

You can hire only after you become a certified legal entity in the foreign country |

|

Payroll |

Payment automation with HRMS software to ensure quick and timely payout to all employees and contractors |

Your in-house team keeps track of every employee’s statutory deduction and entitlement benefits |

|

Taxes |

EOR partner’s knowledge of Indian tax laws comes to your aid, and they make sure you are functional, compliant, and up-to-date on all tax obligations |

You will need your legal compliance team to handle the surplus tax-related issues when you are running a legal entity, which goes beyond employee taxations |

Does hiring employees in India with EOR seem like a good option to you now? Asanify EOR can help you start hiring in just 1 day – let us show you how.

Employee Classification and Indian Market Info

India is a global hotspot for hiring employees and remote workers who can deliver expert skills at competitive charges, much lower than native skilled workers.

With the evolving nature of the Indian job market, employers need to understand the clear demarcation between full-time employees and independent contractors. Confusing between the two maybe legally costly for the company.

Read this table to figure out the employees that are best for your company:

Indian workers classification: Employee & Contractor | |

|

Employee |

Contractor |

|

Employees are intricately absorbed in the employer’s business – working solely with one company. |

Contractors can work with other companies if they want to – they are not exclusively tied to an organization’s work process. |

|

Employees are generally employed on a full-time basis – they are required to complete a set of scheduled tasks in a day. |

Contracts have flexible employment – they can be hired on a project basis and are given much more flexibility to complete work on their own time. |

|

Have specific work hours in a workday. They are required to sign in at a specific time every day to regularize their attendance. |

Don’t have specific work hours. They are not required to regularize attendance and can work whenever they like. |

|

Employees in India enjoy general employment benefits like health insurance, retirement plans, and sick leave. |

Contractors don’t enjoy any employment benefits and protection. Moreover, they are responsible for paying their taxes and managing their health insurance. |

|

Employees are responsible for doing the work by themselves and delegate the work to anybody else. |

Contractors can subcontract the work to other contractors if they see the need and their contract allows it. |

|

Companies provide employees with tools and machines to do their work. |

Contractors bring their own tools and machines – company is not liable to support them with tools. |

|

Employees can work regularly from office or be full-time remote workers, working away from the office while their work gets monitored with tracking softwares. |

Contractors are generally remote workers – their task progress gets monitored by project management software or HRMS software, but day-to-day progress is not tracked. |

Suggested Read: Salary Benchmarking in India- What are the Average Salaries in India for Top Roles?

Understand the Indian Job Market before hiring employees in India

India offers a rich talent pool in key industries like IT, manufacturing, healthcare, finance, and retail. Each industry has unique characteristics and hiring needs. Let’s explore them:

Information Technology (IT):

- India is a global IT powerhouse with over 5.4 million professionals.

- Find top-notch software developers, data analysts, and cybersecurity experts.

- Ideal for outsourcing IT projects.

Manufacturing:

- A massive sector employing 35.6 million workers.

- Covers industries like automobiles, consumer goods, and textiles.

- Growing rapidly due to government initiatives like “Make in India.”

Service Industry:

- Includes healthcare, hospitality, and professional services.

- Employs 30.7% of the Indian workforce.

- Offers ample opportunities for remote workers.

- Contributes significantly to India’s GDP.

In a nutshell, these industries are bubbling with skilled professionals and should be your first pick when you are hiring remote workers in India.

Best Way To Hire Employees In India – Know The Current Employment Trends

Recruiters Prioritize Skills Over Traditional Qualifications

Indian recruiters are increasingly focused on finding skilled and experienced talent, rather than relying solely on academic credentials. This approach opens doors for a wider and more diverse pool of candidates.

A Modern Workforce Ready for Global Challenges

The Indian workforce is well-prepared to adapt to global work practices and emerging trends like AI and fintech. Many professionals also embrace the gig economy, working as independent contractors or freelancers. By hiring remote workers in India, countless companies amplify their workforce with skilled and affordable labor.

Embracing Metaverse Technologies for Hiring and Management

The growing popularity of the gig economy and global attention have made Indian workers comfortable with metaverse-based hiring and management tools. Virtual interviews and metaverse HRMS portals streamline the process of hiring and managing remote employees in India.

Understanding Indian Work Culture

Indian work culture blends traditional values with modern practices. Here are some key aspects:

- Hierarchical Structure: Clear chain of command and top-down decision-making.

- Teamwork and Collaboration: Emphasis on working together and building relationships.

- Flexible Timekeeping: Punctuality is valued, but meetings may start slightly late.

Recommended Read: EOR India- A Detailed Guide on Employer of Record

Where To Hire Indian Workers?

Indian workforce can be found on the various job portals active in the country, namely:

- Naukri

- Indeed

- Shine

- TimesJobs

These portals are good for finding and hiring employees in India – in full-time, part-time, or contractual roles.

But if you want access to the best and brightest talent – they are probably working at their current job, waiting to make a switch to an opportunity with better perks. As an outsider, you need a helping hand to access these talents and start hiring employees in India.

With Asanify EOR, find out how you can leverage our existing network and deep knowledge of the Indian job market to track and hire the best talents your business needs.

How To Hire Employees in India?

As a non-Indian company when you’re focused on expanding your business in the Indian market you’ll naturally want to know the cost of hiring employees in India and the selection process involved here.

Although India is a highly economic market as compared to its European or US counterparts, the hiring cost can be as high as INR 15,000 for a fresher employee and as high as INR 2,00,000 for an executive role. But if you take the help of EOR in hiring employees from India – the effective hiring cost reduces by a wide margin.

Have a look at the table to understand the best way to hire employees in India:

Checklist for Hiring Employees in India | ||

Steps | Responsibility | Details |

|

Finding employees & contractors |

EOR |

Best way to hire employees in India is to go on online portals like LinkedIn, Indeed, and Naukri and look for eligible talent. |

|

Conducting Interviews |

EOR |

Once a talent is shortlisted, they go through a rigorous interview process based on your business needs and your HR guidelines |

|

Final shortlisting of a candidate and sharing the offer letter |

EOR and Company |

After the final interview rounds are over and you shortlist a candidate, send them an offer letter outlining their job roles, work hours, role expectations, salary breakdown, benefits, etc |

|

On Candidate Selection |

EOR and Company |

Get official information verified: national ID docs like PAN card, Aadhar card, phone number, emergency contact, official mail, address, bank details, completion of notice period document, etc |

|

Share employment contract |

EOR |

Once the candidate has agreed to the offer letter, draft an employment contract adhering to Indian labor and employment laws. |

|

Conduct Background checks |

EOR |

Verify the authenticity of the documents once the candidate accepts the employment contract |

|

Onboarding processes |

EOR and Company | 1. Company should send a welcome email 2. Ask them to complete the official work concerning their employment documents ie contract signing, NDA signing, tax details etc. 3. Get their information and set up payroll, salary accounts, etc. 4. Give them a walkthrough of the HRIS system 5. Company gives them a brief of the company policies with an orientation 6. Setting them up with machines, software, official accounts, passwords, and communication channels 7. Assign a buddy to get them accustomed to a new environment |

Recommended Read: How to Design an Hiring Policy for Small Businesses?

Employee Contract

An employer contract is a healthy HR practice encouraged in India even though it’s not mandated by the government. Clearly laid out terms make the terms of the employment explicitly clear – factoring in the company policies, employment details, mutually agreed unique terms, and clause of termination.

Non-Disclosure Agreement (NDA)

When companies with a unique product are hiring employees in India, their employees must sign a non-disclosure agreement (NDA) document. Once signed, this document is legally binding and prohibits employees from revealing trade secrets, sensitive information, or Intellectual Property that makes their product unique. Breach of information will attract serious legal charges, escalating to criminal charges even depending on the severity of the leaked information.

As long as the employee has even basic access to their sensitive information, companies have to get all their employees to sign the document whether they hiring remote workers in India or full-time employees.

Background Check

Hiring employees in India is a daunting task for non-Indian companies, because it’s an entirely different society and culture, so building trust can take a while. That’s why it’s reasonable to conduct background checks before their employees join. Checks are aimed to reveal and verify:

- Criminal History

- Work Records

- Educational Records/Skill Certificates

- References

- Work Authorization

- Credit Report

Onboarding Checklist

When you have successfully hired an employee, you must take them through the onboarding process – which is more than just a paper trail. Follow our onboarding checklist for the best way to hire employees in India:

Before First Day:

- Do background checks on their employment and personal history to rule out any dubious or criminal record

- Send an offer letter

- Collect information for payroll and taxes – Personal Address Number (PAN) and Tax Account Collection Number (TAN)

- Send a welcome mail

- Add them to payroll and benefits

- Set up their device and account access

On First Day:

- Hand over their fresh workspace

- Give them an agenda for the day

- Connect them with an onboarding mentor and a work buddy

- Schedule a meet and greet with the manager

- Give them an office tour

- Hand out a list of contacts in various departments

- Show them the security drill of the workspace

The onboarding session can last as long as 60 days where they are introduced to:

- Role-specific training sessions

- They are assigned work and given additional support until they get accustomed

India is projected to have a surplus of 1 million highly-skilled tech workers by 2030, reveals reports.

Payroll, Wages, Taxes and Employee Benefits

Running Payroll for Indian Hires

Whether you are hiring employees in India either through EOR or by your legal entity – here are the steps you’ll need to follow when running payroll for your Indian employees:

- Finalize their employment status – there are more deductions and payroll complications for employees as compared to independent contractors.

- Choose a payroll software solution – Asanify can help you out in your search for employers in India as well as end-to-end payroll management software. Our incredible HRMS allows you to smoothly process payroll for contractors and employees residing in any corner of the world.

- Furthermore, get the vital details like name, address, phone number, PAN and TAN details, date of birth, bank details, and account number for Employee Provident Fund.

- Pay your Indian employees in rupees

- Run payroll and ensure you are compliant with your tax filings.

Have a look at the tax filing table to understand how you will have to pay taxes based on the current tax regime.

Also Read: Salary Structure in India- The Ultimate Expert Guide

Taxes In India

|

Income Tax in India – Tax on Earnings (2024 – 25) | |

|

Income Tax Slabs (INR) |

Income Tax Rate |

|

Till 3,00,000 |

0% |

|

3,00,001 – 7,00,000 |

5% |

|

7,00,001 – 10,00,000 |

10% |

|

10,00,001 – 12,00,000 |

15% |

|

12,00,001 – 15,00,000 |

20% |

|

Above 15,00,001 |

30% |

The financial year in India commences on 1st April and concludes on 31st March every year. Thus workers and employers in India need to compulsorily file their taxes by 31st July. Here’s a brief overview of the tax compliance norms in India:

- Professional Tax (PT) – Professional tax is levied by state governments on income earned by employees. Employers are responsible for deducting and remitting this tax.

- Tax Deducted at Source (TDS) – Employers are required to deduct TDS from employees’ salaries based on their income tax slabs. This amount needs to be deposited with the government every month.

- Goods and Services Tax (GST) – This tax applies to the supply of goods and services. If the employer’s annual turnover exceeds the prescribed limit, they must register for GST.

- Employee Tax Declarations – Employers must collect and verify tax declarations from employees, which help in determining the TDS to be deducted.

- Income Tax Returns (ITR) – Employers should issue Form 16 to employees, summarizing the salary details and TDS deducted. Employees then use this information to file their income tax returns.

Don’t want to load your head with chunks of tax norms when you’re hiring employees in India? Use Asanify EOR to streamline the hiring process and abide by tax regulations. So if you are wondering how to hire employers in India, just book a meeting with our expert and get started in 24 hours.

Suggested Read: Top 10 Tax-saving Tips

Benefits For Indian Employees

Before you work towards forming your remote team in India, it is a must to familiarize yourself with the mandatory employee benefits you need to offer your employees.

Special Leave Benefits

1. Maternity Leave Policy

Maternity leave policies are governed by the Maternity Benefit Act, of 1961. Crucial aspects concerning this leave policy include:

Duration of Leave – Women are entitled to a maximum of 26 weeks of maternity leave.

Applicability – The Act applies to every establishment with 10 or more employees. It covers all women employees, whether they are full-time employees or contractual agents.

Payment during Maternity Leave – For the period of maternity leave, the employee is entitled to receive a salary at the rate of the average daily wage for the period of her actual absence.

2. Paternity Leave – It’s not mandatory to allow paternity leave in India yet, but any organization is free to offer it.

Recommended Read: Leave Policy for Employees- Download Expert-guided Templates

Social Contributions Mandatory For Employers

When you’re hiring employees in India, budget for legally mandated social contributions as well. Social contributions play a pivotal role in promoting a sense of financial security among employees.

They serve as a safe financial net during unforeseen circumstances, such as illness or accidents. Most importantly, mandatory social contributions foster a sense of responsibility among employers, encouraging them to prioritize the welfare of their employees.

1. Employees’ Provident Fund (EPF)

The Employees’ Provident Fund (EPF) in India is a social security initiative managed by the Employees’ Provident Fund Organization (EPFO). It specifically aims to provide financial security and stability to employees by facilitating savings for retirement.

Eligibility – Applicable to establishments with 20 or more employees. Voluntary for establishments with fewer than 20 employees.

2. Employees’ Pension Scheme (EPS)

8.33% of the employer’s contribution is directed towards the Employee Pension Scheme or EPS.

3. Employees’ Deposit Linked Insurance Scheme

The Employees’ Deposit Linked Insurance (EDLI) scheme is a social security program provided by the Employees’ Provident Fund Organization (EPFO) in India. It is designed to provide life insurance coverage to employees, particularly those who are members of the Employees’ Provident Fund (EPF). Here are the key details:

Eligibility: The scheme provides life insurance coverage to all EPF members. It covers both private and public sector employees who contribute to the EPF.

4. Employees’ State Insurance (ESI)

Employees’ State Insurance (ESI) is a social security and health insurance scheme in India. It is administered by the Employees’ State Insurance Corporation (ESIC), an autonomous body created by the government. The primary objective of ESI is to provide financial and medical benefits to employees and their dependents in case of sickness, maternity, disablement, or death due to employment-related injuries.

Eligibility – ESI applies to organizations with 10 or more employees (in some states, it’s 20 employees).

Failing to contribute to social security funds is marked as non-compliance which can attract penalties from the government in the form of fines and even legal action.

You may also like to check out: What is ESI? Everything You Need to Know!

Work Permit

When you are hiring employees in India who are not Indian citizens, your new hire needs to carry either of these two documents to practice their business in a compliant manner in India:

1. Employment Visa or E-Visa

This is generally granted to skilled professionals or highly qualified individuals working with registered companies in India. It’s essential for non-Indian citizens seeking employment in India.

If applicants don’t intend to travel, they can apply for a single entry visa. Multiple entry visas would suit applicants who plan to leave the country at certain intervals.

2. Business Visa

While not a work permit per se, a Business Visa allows foreign nationals to explore business opportunities, attend conferences, and make business-related visits to India.

What is the Cost To Hire Employees in India?

Since you are about to embark on the journey of employing local talent in India, having a clear idea of the hiring cost is essential. After all, your business expansion plans will be dependent on this factor. Say, you are going to hire an employee who is based out of Bangalore or Mumbai. In such a case, taking into account the real hiring cost is a must.

Usually, the hiring cost for employers in India can vary widely depending on factors such as the industry, the level of the position, and the recruitment methods used. Let’s see what are the key components that contribute to the overall hiring cost:

1. Recruitment Channels

Costs associated with using recruitment channels, including job portals, social media platforms, and hiring agencies ought to add to the final hiring cost.

2. Advertising Expenses

If you choose to advertise job openings through various channels, there will be costs related to creating and placing these advertisements. This will then have a direct influence on the hiring cost.

How Does Asanify EOR Help You?

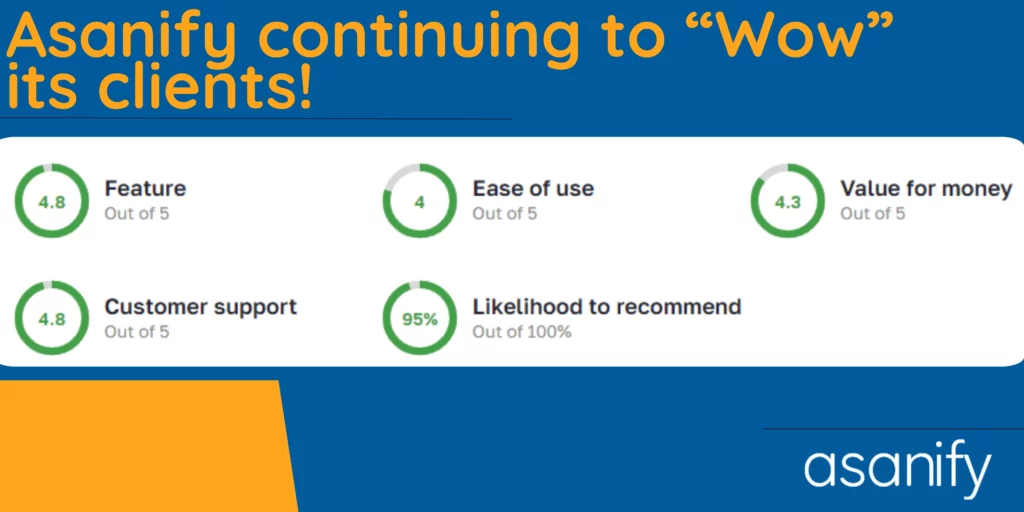

If you’re considering how to hire employers in India, your search ends with Asanify – we have been recognized by G2 as High Performing EOR in 2024.

Asanify offers the best-in-class EOR services for non-Indian companies that are planning to hire employees in India. With a great suite of employer and employee-friendly features in our HRMS, expert knowledge of diverse Indian employment laws, and a well-connected network of executive peers in the Indian industry, we can turn out to be your perfect buddy while you venture out to expand your business in India.

Perks you get when you partner with Asanify EOR:

- Instant option to kick-start hiring employees in India

- Guidance of experts, included in the EOR services, to help you navigate through the Indian legal landscape – especially, in the areas of employment laws and India payroll taxes.

- Relief from handling mind-boggling HR tasks for your employees.

Schedule a Demo today to get started.

Laws and Compliance Best Practices to Hire Employees in India

Labor Laws

Labor laws vary from country to country, that’s why Indian labor laws are unique and distinct from US laws. When you’re hiring employees in India, best to remember these broad labor practices and ensure you are fair with your workforce and compliant with Indian law:

- Unlike US, India does not recognize at-will employment. This means you can’t terminate employment without just cause and have to give the terminated employee a notice period before they can be completely ejected.

- Laws are different for independent contractors and employees – when you’re hiring remote workers in India, be aware of this and avoid misclassification.

- Indian workers can congregate and form trade unions to communicate their collective interests to the employer.

- Employers have to pay minimum wage to all their hired employees – the minimum wage varies from industry to industry and is dependent on the skill quality of the hire.

Compliances Related to Hiring Employees in India

- Employment Contracts – Though this is not a government mandated policy, employment contracts are one of the best ways to hire employees in India and a healthy HR practice in general.

- Understanding India’s current tax regime is an essential compliance factor. It’s quite complicated, so ensure you consult with a tax lawyer to have all the information.

- You have to invest in social security funds when you are hiring remote workers in India – non-compliance will attract fines and penalties.

- Indian laws protect employees from discrimination based on color, caste, religion, or gender. If discriminatory practices are reported, the company can land in serious trouble.

- The best way to hire Indian workers is to ensure a socially safe and hygienic working environment. Non-compliance will invite legal action. However, if you are only hiring remote workers in India, you need to update the social security and communication guidelines for remote work etiquette.

- Have empathy and understanding of local customs

- Have fair termination policies, comply with India’s labor laws, and outline the policies clearly in the contract document.

Broadly speaking these are some of the important compliance factors one needs to be aware of when hiring employees in India. Moreover, this broad information also helps you figure out an assessment strategy when you are wondering how to hire employers in India.

India is the home to the world’s third-largest web 3.0 workforce, reveals studies.

Protecting Company Intellectual Property (IP)

When you’re hiring employees from India, make sure you protect the unique and original ideas that form the core of your business. Government of India has employer friendly provisions of IP protection that safeguard your IP rights from being misused.

The seven kinds of IP rights that India recognizes are:

- Patents;

- Copyrights for literary, artistic, and creative works;

- Geographical Indication or GI tags of goods;

- Trademarks;

- Industrial designs;

- Plant diversities;

- Semiconductor integrated circuits

So keeping these laws in mind, construct an iron-clad IP protection strategy that fortifies your sensitive information. Some good strategies to safeguard information are:

- Non-Disclosure Agreements (NDAs) – Require employees to sign NDAs to ensure they understand the confidential nature of the company’s information and agree not to disclose it.

- Employment Contracts – Clearly define intellectual property ownership in employment contracts. Specify that any work-related inventions, designs, or developments belong to the company.

- Non-Compete and Non-Solicitation Clauses – Include clauses that restrict employees from working for competitors or soliciting clients or colleagues for a certain period after leaving the company.

- Access Controls and Info sharing on need to know basis – Limit access to sensitive information only to employees who need it for their job responsibilities. Implement strong access controls and monitor data access.

- Security Policies – Establish comprehensive security policies, including password protection, data encryption, and secure communication practices, to prevent unauthorized access.

- Remote Work Policies – In case employees work remotely, establish secure protocols for accessing company data and devices, including the use of virtual private networks (VPNs) and secure communication tools.

- Thorough Exit Interviews – Conduct thorough exit interviews to remind departing employees of their ongoing obligations regarding confidentiality and IP protection.

Hire a good cybersecurity and IP-specializing legal team who can advise you and help to create a robust framework that will protect all your sensitive information and company interests.

74% of Indian workers are keen on flexible work options. (Source: Microsoft Work Trend Index)

Offboarding

An employee can fired in India based on low performance issues, workplace misconduct, insubordination, espionage, and discreet reasons. But if let go without a cause, the employee has to be given a notice period of at least 30 days before they can be laid off from the company effectively.

However, if the employee is being let go during the probationary period, they don’t need to be given a notice period and can be laid off immediately. As an employer, be sure to include the terms of termination in the contract agreement the employee signs at the time of joining to avoid any surprises and unwanted legal action.

Recommended Read: Full and Final Settlement- See How to Run Termination Payroll

Conclusion

Hiring employees in India can be a game-changer for your business, but it’s important to navigate the market with the right strategies. That’s where Asanify EOR comes in. We’re your partner in simplifying the hiring process, handling all the HR complexities, and offering end-to-end employee management so that you can focus on growing your business.

Imagine having access to a diverse pool of talented Indian professionals, all while ensuring compliance with local labor laws without having to expend time and resources on employee management. When you partner with Asanify EOR, it’s a profitable reality.

Click Here to book a demo of our services.

FAQs

Employer of Record (EOR) is a service that helps foreign companies in hiring employees in India without establishing a legal entity. The EOR takes on the role of the official employer, handling payroll, benefits, and compliance.

EOR is one of the best ways to hire employees in India as it streamlines the hiring process, ensures compliance with local laws, and minimizes administrative burdens. It also provides flexibility, allowing companies to scale their workforce by hiring remote workers in India without the complexities of establishing a legal presence.

Compliance with Indian labor laws is crucial. EOR providers navigate legal requirements, covering everything from tax withholding to employment contracts, ensuring companies meet local obligations.

The EOR manages payroll, withholding taxes, and statutory contributions on behalf of the foreign company. This includes income tax, provident fund, and other applicable taxes, ensuring adherence to Indian tax regulations.

Yes, EOR is particularly beneficial for short-term or project-based hires. It offers the flexibility to engage employees for specific durations without any long-term commitment or legal complexities.

EOR is the best way to hire employees in India and can be used to hire for various roles, including full-time, part-time, and contract positions. However, certain specialized roles or industries may have specific regulatory considerations.

EOR providers typically handle employee benefits, ensuring compliance with local regulations. This may include health insurance, provident fund contributions, and other statutory benefits required by Indian law.

Begin by selecting a reputable EOR provider with experience in India like Asanify. Provide necessary information about the hiring needs, and the EOR will guide you through the onboarding process, handling legalities and paperwork.

While costs vary, EOR is often more cost-effective than setting up a legal entity. It eliminates upfront investment, ongoing drag on time and resources, allowing companies to focus on their core business activities.

Yes, EOR is well-suited for hiring remote workers in India. It provides a compliant and efficient solution for engaging remote talent without the need for a physical presence in the country.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.