Knowing how to pay contractors efficiently in your business has become essential in today’s gig economy, with more and more companies hiring contract employees in specific roles. Especially in a scenario, where as a business owner you are constantly looking to expand into newer territories, you may feel the need to hire contractors suited for a particular kind of job. Another scenario where streamlining contractor payment is a must is when companies hire interns or freelancers. Contractor jobs and freelance assignments are becoming increasingly common even in large organizations, and you may sometimes even hire contractors globally. How then do you pay contractors efficiently? Are there specific rules relating to independent contractors? In this article, we will cover all that you need to know about contractor payments, whether it is within your country or globally.

Topics that we will cover:

- Best way to pay contractors

- Pay your contractors in 3 easy steps

- Who is eligible to receive contractor payments?

- Should a small business employ contractors?

- Which industries require contractors and how to source them?

- 4 factors to consider before hiring a contractor

- How to pay contractors in Australia

- How to pay contractors in the United States

- How to pay contractors in Canada

- How do contractors pay taxes in the United States?

- How do contractors pay taxes in India?

- Wrap Up

- FAQs

Best way to pay contractors

We will now take a look at what are the best ways in which you can pay your contractors efficiently.

1. Pay Contractors using a Payroll Software

Subscribing to a contractor payroll software is by far the best way to make your contractor payment. Be it for your domestic contract employees, or even international contractors, a good contractor payroll software allows you to manage your contract employees and their payouts effectively. You may want to check out Asanify’s Contractor Management Software

Benefits of a Contractor Payroll Software

- Consolidated payouts for all your contractors. This is especially useful if you hire multiple contractors with different payment terms

- Online invoice generation for your contractors

- You can choose your payment mode either through the integration with banks for the direct debit facility, or by transferring yourself

- Keep track of your monthly payroll costs

- Real-time access for your contractors to their payment details through a self-serve portal

Some concerns

- Contractor management systems are subscription products, so you will need to buy this separately

Suggested Read: 10 Best Contractor Management Software in 2024 [Reviewed]

Want to know more about how Asanify Contractor Management Software may help you in your business? Book a meeting now.

2. ACH Transfers to Pay Contractors

ACH Transfers refer to the movement of money from one Bank Account to the other via the Automated Clearing House network. This is method is popular in the US, as the network spans over 11,000 Financial institutions.

Benefits of ACH Transfers

- It is a relatively inexpensive way of transferring payments

- As against writing Checks, the process is completely digital and less manual

Some concerns

- Bulk ACH Transfers are facilitated through third-party payment aggregators, and thereby the overall cost of transaction shoots up

- The contractor invoicing is not available and that may have challenges in terms of compliance adherence

- The overall process, while it is better than Checks, is still manual and time-consuming as the payment amount may keep changing

3. Pay Contractors using Credit Cards

As users, transactions done on Credit Cards obviously will feel the most convenient to us and also provides us with some credit period, but it is still not the preferred mode for contractor payments.

Some concerns

- Your contractors need to have a Merchant Account to accept card payments

- The contractor invoicing is again not available and that may have challenges in terms of compliance adherence

- In a scenario where you have hired many contractors, you may soon exhaust the credit limit on your card

4. Wire Transfers for Contractor Payment

If time is of critical importance, Wire Transfer of money may be a better option for you, though it does come with its own challenges.

Benefits of Wire Transfers

- Quicker transfer of payments to your Contractors

- This mode is usually used for international money transfers

Some concerns

- Wire Transfer of payroll is a very expensive way of transferring money where it may cost you USD 15-20 per transaction

- Reversal of these transactions is next to impossible, hence must be used only when you completely trust the recipient’s details

- Not a recommended mode of payment for frequently carried out transactions like the Payroll

5. Online Payment System to Pay Contractors

There are several online payment service providers to facilitate money transfers for your contractors. Paypal, for example, is the biggest of them all and has a presence across 200 countries. While these online payment systems score very high in terms of convenience, the actual cost of these transactions works out to be ridiculously high.

Benefits of Online Payment Systems

- Quick. And very convenient

- Large acceptance almost anywhere in the world

Some concerns

- The charges for these transactions are ridiculously high

- The overall transaction charges, especially in the case of foreign transfers, are often hidden behind the FX conversion rates

- Your contractors will also need to have a Paypal kind of business account for them to receive the payments

6. Freelancer Platforms to Hire and Pay Contractors

The Freelancer platforms, like Upwork and Fiverr, are marketplaces where you will find numerous contract workers for the specific kind of work that you are looking for. The platform also creates a seamless interface for the milestone-based payments that you may be looking for and shows you the past reviews and ratings of these contract workers. However, if you have your contractors in your business already, there is really no point in making them register on these platforms just so that you can make their payouts. And, in any case, the platform fee gets charged at both ends i.e. Contractor-end and Client-end which makes the overall process economically not feasible.

Pros of Freelancer Platforms

- These are marketplaces to find talent that can work for you for various projects. It is not a contractor payment platform per se.

Some concerns

- The charges for these transactions are ridiculously high if you already have the contractor you want to work with

- Consolidated payout is near impossible because different project milestones are set differently and you will not be able to standardize the payout timelines for each of your contractors

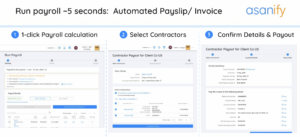

Pay your contractors in 3 easy steps

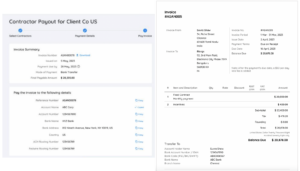

Paying your contractors using Payroll Software is a breeze. In 3 easy steps, you can run the payroll and initiate the transfer of money either through a direct debit of your bank account or by making the payment transaction separately. And, to add to this, you can customize the pay cycle exactly as per your requirement whether it is choosing your pay cycles (i.e. weekly / fortnightly or monthly) or the basis of payment (i.e. hours worked, the unit of output, etc.).

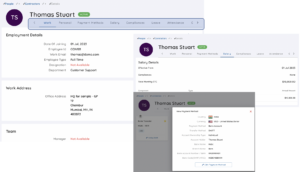

Step 1 to Pay Contractors – Add them to the Payroll Platform

You can add your contractor details on the Payroll Platform either by making an individual entry or by importing the Excel Sheet with all your contractor details. You can capture all their work-related and personal details apart from the Payment Method, Bank Account Details etc.

This ensures that the Payroll Platform also becomes the HR Information System for your contractors. you may want to check out Asanify’s Contractor Management System.

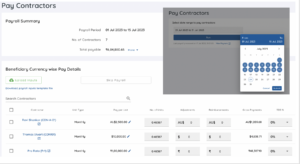

Step 2 to Pay Contractors – Choose your Pay Cycle and Run Payroll

Payroll Software allows you to choose your pay cycle according to your business requirement. This could be daily, weekly, fortnightly, monthly, or even based on the output of your individual contractors. At the click of a button, the system runs the payroll and arrives at the total payable amount for each individual contractor. You can also choose to modify the payments by adding other components like expense reimbursements, bonus or you may even deduct a certain amount, in case you need to.

Once you confirm the payroll, the system finalizes the amounts and generates your Contractor Invoice. This ensures complete documentation for your contractors. you may want to check out Asanify’s Contractor Management System.

Step 3 to Pay Contractors – Invoice Generation and Bank Transfer

The last stage of your contractor payroll gets automated at the time of your account setup. Your bank details are updated, or any direct debit instructions that need to be given to your bank can be done. You may even choose to transfer the money using your Credit Card, although it is not the most preferred option if the amount to be paid is large.

Keen to know the details of how successful businesses are using the Payroll Platform to make their Contractor payments? Read our detailed case study on DirectShifts, a YC-funded US-based startup, and how they are managing their independent contractors in India.

Who is eligible to receive contractor payments?

First, let’s try to understand who is termed as a contractor. The primary point of differentiation is, of course, financial control. If an employee is being paid a regular monthly/annual salary, he/she is a salaried or regular employee. However, if the worker is paid a specific amount per job, they fall under the contractors or freelancers category. Besides, it is important to note that contractors are self-employed professionals and they set their own pay rates and the terms of payments may vary from one contractor to the other.

Additionally, contractor payroll also differs in terms of legal and local compliances. For example, salaried employees may have several benefits and tax deductions on their payslips. In contrast, contractors or freelancers are not withheld by Income tax and other deductions. Similarly, while your employees have a fixed pay cycle e.g. monthly or weekly payouts, the contractors could have their payouts determined either by time or unit of work. Moreover, employment and labor laws are also different when it comes to contractor payments. The relationship between a contractor and employer usually terminates at the end of the signed contract and/or completion of the job.

Should a small business employ contractors?

Every hiring decision has pros and cons associated with it. When a business is starting out, hiring contractors can help build it with a lot of benefits. As we’ll see later on, contractors do not require health insurance, paid leaves, or fixed salary amounts. This helps keep small business or startup budgets financially intact. Furthermore, contractors can also provide certain business development advantages as the payments to the contractors can be directly linked to the business output. Regular employees, on the other hand, have long-term benefits and can prove to be more loyal and attached to the organization’s values. They can be groomed to become part of the core business teams and, in the medium to long term can even lead product divisions.

What are the pros of hiring a contractor?

- Contractors are paid on a contractual basis and thus have set timelines for completion of work

- They can be employed at much lower costs than full-time employees

- Startups in their early stages often require subject matter experts. Eg. Tech experts, Business compliance experts, etc.

- You get clear ROI (Return on Investment) as the payout to contractors can be completely delivery-linked

What are the pros of hiring a full-time employee?

- Salaried employees are more suited to work in the core delivery areas of the business

- They score higher on loyalty and abiding by the company’s culture

- Add more value to the business in the long run

- You can structure the employee salary to also include variable components like Bonuses, Incentives, etc.

Which industries require contractors and how do you source them?

The answer to this question lies in the fact that all businesses have different hiring requirements. However, most companies end up hiring contractors or freelancers at some point or the other. With the rising gig economy, and given the business need for specialists for the short term, the need for contractors and freelance jobs has become widespread. That added to the rise in remote work due to COVID-19 has changed conventional business practices.

- If you’re looking for contractors in the UX/UI design sphere, check out 99designs

- For freelancers, browse through Upwork or Fiverr

- For interns in any field, Internshala and KillerLaunch are good options

4 factors to consider before hiring a contractor

Making the decision of hiring a contractor for a few projects is great. Here are 4 main factors to consider before you move forward:

1.Tax Management

Contractor payments differ from paying your regular employees. Moreover, tax rules and compliances are also different when it comes to independent contractors. In the following section, we’ll see what these rules are and how to manage your contractor’s tax payments.

2. Number of Contractors

The higher number of contractors you employ, the more time you will have to spend on payroll. Instead, draw out a plan on the exact number of contractors you require for specific jobs. This will help save time on collecting tax information, tracking hours, and issuing payments. In addition, keep information relating to the mode of payment at hand after discussing it with the contractor.

3. Frequency of Contractor Payments

This is a key factor to consider. Before venturing into the world of hiring contractors, understand the modes of payment and frequency of making those payments. Furthermore, consider things such as transfer fees, advance payments, one-time payments, etc. Will you be paying the contractor every week? If it’s a long term project, will there be regular payments every month? These are questions you should have answers to beforehand.

4. Location of Contractor

Independent contractors can also be remote workers. Sometimes you may have to hire someone who works outside your state or even national boundaries. As a result, different state rules for taxes or exchange rates may have to be thought of. Additionally, the contracts will have to be designed according to work hours and charges.

How to pay contractors in Australia

In Australia, the ATO levies income tax on independent contractors as well. However, these contractors are treated as businesses, and the tax rates follow the company rates which tend to be lower than that for the employees. As an employer, you do not need to withhold any taxes for your independent contractors as the liability for tax payment rests with the contractor themselves. In order to keep the overall tax liability manageable, contractors usually pay these taxes once every quarter. It is important to note that contractors can also claim various business-related tax deductions since they are working for themselves, and this reduces their overall tax liability.

In case you are hiring international contractors for your Australian Company, you may also note that Australia has Tax Treaties with over 40 countries in the world that help your contractors avoid double taxation. This list of countries is maintained by the Treasury and can be seen here.

Apart from the best ways to Pay your Contractors, as given above, in Australia cryptocurrencies like Bitcoin are legal to use (although it is not classified as a legal tender). You may pay your Contractors in cryptocurrencies, and in Australia, these transactions are treated as barter transactions.

How to pay contractors in the United States

While hiring a 1099 Contractor in the United States, it is important to work out a few details. While these independent contractors will file their own taxes using the 1099, as an employer you are also expected to report your contractor payment on a 1099 NEC form. While preparing the documents for paying a 1099 contractor is easy, it is of utmost importance that you double-check all the information that has been filled in. You must also ensure that the independent contractors for your business have been classified appropriately. Once you have done this, you may choose the most suitable way for you to make the contractor payments.

The best ways to Pay your Contractors, as given above, will be helpful for you to choose the best medium. Traditionally, small businesses have relied heavily on Direct Deposits and ACH Transfers. Even today over 90% of the employee salaries are paid using ACH transfers. However, in order to streamline the Contractor Payroll, and Invoicing – Payroll platforms like Asanify are the most widely preferred options. This is especially true in the case where frequent payments (i.e. weekly or fortnightly) have to be made to your contractors, and in such cases either the direct deposit process becomes too tedious or the ACH limits get exhausted.

How do contractors pay taxes in the United States?

When it comes to Taxes and Compliances, each country has a different regulation regarding the applicable taxes and the corresponding deductions while running your payroll. There is one fundamental difference between an employee and a contractor when it comes to Payroll. While in the case of Employees, in the US, you are expected to deduct the taxes while making the payout, in the case of Contractors, the tax payments are handled by the contractors themselves. As an employer, you are supposed to file Form 1099 to show the payments made to independent contractors.

The IRS requires independent contractors, and also the sole proprietors, to pay their estimated income tax quarterly using the form 1040-ES. This is particularly beneficial as it helps contractors to avoid a large tax liability at the end of the year.

Click here to read our Detailed Guide on How to File Form 1099

How to pay contractors in Canada

Like in other countries, in Canada too, the independent contractors are supposed to pay their own taxes. There is no withholding of tax by employers. However, the employer will have to issue the T4A form to show how much has the contractor been compensated for their work. This T4A form is used by contractors to file their individual taxes. It is important to note that if you are an independent contractor based in Quebec, you may also have to file the form RL-1.

Like, in the case of the US, even for Canada the best way of managing your Contractor Payroll, and Invoicing is through Payroll Software that facilitates end-to-end management of your independent contractors.

Paying Contractors in the UK?

Click here to read our detailed blog on how to pay your contractors in the UK.

How do contractors pay taxes in India?

Employers are not usually required to withhold or pay Income Tax for their Contractors in India. Independent contractors are supposed to pay and file their own income tax if they earn more than INR 2,50,000. If the tax liability of a contractor is more than INR 10,000 they are supposed to file their income tax quarterly, and not annually. An important point to note also is that if you are a sole proprietor in India, you are not supposed to fill out a separate tax return or pay corporate tax. You may simply just pay your personal income tax on your business profit using the form ITR-3.

Freelancers in India do come under the purview of Income Tax and GST (i.e. Goods and Services Tax). If a freelancer’s aggregate turnover is more than INR 20,00,000 – it is mandatory to register under the GST. For most services offered in India, the rate of GST is 18%. If you are a freelancer in the North Eastern and Hill States in India, the limit for GST registration is INR 10,00,000.

Section 194C: The Indian legal guide to contractor payments

Section 194 C of the Income Tax Department of India provides the laws for tax deductions for contractor and subcontractor payments. It states that any person working within the limits of a contract must deduct tax at source (TDS).

Moreover, this contract must be between a contractor and one or more of the below-mentioned parties:

- The Central Government or any State Government

- Any local authority

- Corporations established by or under a Central, State, or Provisional Act

- Any company

- Any co-operative society

- Authority constituted in India by or under any law, engaged either for the purpose of dealing with and satisfying the needs for housing accommodation or for the purpose of planning, development or improvement of cities, towns, and villages or for both

- Societies registered under the Society Registration Act, 1980 or under any such corresponding law to the Act in any Part of India

- Any trust

- Universities or deemed universities

- Any firm

What kind of work does section 194C cover?

Before we get into the particulars of tax and payments, let’s understand what ‘work’ is defined as for Indian contractors. As stated in Section 194C, ‘work’ for contractors or sub-contractors includes:

- Advertising

- Broadcasting and telecasting; programs for broadcasting or telecasting

- Carriage of goods and passengers by any transport excluding railways

- Catering

- Manufacture and/or supply of products by purchasing material only through a direct relationship with the customer

When does TDS get deducted for contractors?

Under section 194C, tax is deducted for contractor payments either at the time of the amount being credited or at the time of payment. Additionally, this payment can be either in the form of cash, cheque, or other modes.

Consequently, any amount credited to the account of the contractor or sub-contractor is taxable at the source by the employer.

How much TDS is deducted for contractor payments?

According to Section 194C, there are 2 TDS rates applicable for contractor payments:

- If the recipient is an individual/ Hindu undivided family: 1%

- If the recipient is any other person: 2%

Furthermore, there are a number of points to consider when paying your contractors.

The surcharge or health and education cess are not applicable to contractor payments.

The surcharge or health and education cess are not applicable to contractor payments. - If the contractor does not provide the employer with his/her PAN card, a 20% tax is deducted.

- If the contract corresponds to the manufacturing or supply of a product, TDS is deducted from the invoice value. This does not include the value of the material purchased if the amounts are provided separately. But in cases where raw materials are not denoted by a separate component, TDS is deducted from the entire invoice value.

- In addition, for contractor payments, no tax is deducted on the ‘GST on Services’ component if charged separately. Instead, taxes such as IGST, CGST, SGST, and UTGST are included.

When is TDS not deducted on contractor payments?

There are a number of provisions as given by Section 194C for non-deduction of TDS.

1. Tax is not deductible if the credited amount does not exceed INR 30,000. Additionally, it is also not deductible if the aggregate contractor payments do not exceed INR 1,00,000.

2. For transport contractors (plying, hiring, or leasing goods carriages) tax deductions are not applicable if the contractor owns at least 10 goods carriages at any time during the year. He/she must also provide PAN card details to the payer.

3. In the case of contractor payments for personal purposes, no tax is deducted from the credited amount.

4. The Assessing Officer is the main authority in whether contractors can avail of tax exemption or be taxed at a lower rate. Moreover, this application must be through Form No. 13 and must carry PAN details.

Wrap Up

Contractor employees or freelancers are not going anywhere anytime soon. We have seen how important they can prove to be for task completion as well as business development. Here’s a quick recap of what I covered:

- Definition of a contractor and the differences between the former and salaried employees

- Looked into the pros and cons of why a startup should/should not hire contractors

- Industry-wise contractor examples and where to find them

- Factors to consider before hiring a contractor: Taxes, Number of Contractors, Frequency of Payments, and Location

- A deep dive into Section 194C of the Indian IT department which covers tax rules for contractor payments

- A step-by-step guide to setting up a contractor payments account using Asanify Payroll

- Insights into the TDS deductions for Indian contractors, freelancers, and interns

So the next time you’re looking for a contractor, pull up this article and get started with Asanify for free!

FAQs

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.