Running payroll is a lot of hassle. If you are just starting out and your small business has less than five people, then you can use excel for it. MS Excel is one of the most loved applications. It has a multitude of use cases that can be carried out using its formulae and functions.

In this blog:

- What is payroll in Excel?

- Why use Excel for your payroll process?

- 9 steps to carry out payroll in Excel

- What next after payroll calculations in Excel?

- Payroll in Excel: Is it the best option?

- Summary

- FAQs

What is payroll in Excel?

Read this blog for more information about what is payroll. Your payroll process can be carried out using several options. There’s manual payroll, payroll using MS Excel, and specialized payroll software. The process of payroll includes:

- Collecting employee data

- Evaluating total hours worked

- Computing pay and tax deductibles

- Generating and distributing payslips

- Recording and tracking payroll costs

Excel is considered a great tool for payroll management as it is easy to use and versatile. Additionally, it has several functions that allow for simple calculations within seconds. Its simple layout also allows for visual representations of the payroll data. For more tips and tricks, check out the Excel Trick website.

Why use Excel for your payroll process?

Let’s look at a few reasons why Excel is widely used for different payroll activities.

1. Collection and Tracking of Employee Data

Excel as a software can be used for way too many things than we can list down. As a result, it can help businesses right from the first step in payroll. It is used for storing and managing employee details. Furthermore, this data can be stored alphabetically, by particular dates, and by other methods. This provides you with a lot of control over how you enter, manage, and look at data. Since it is easy to manipulate the data in Excel, you can add, remove, and edit it whenever you want. This becomes an increasingly necessary advantage to avoid making mistakes in recording payroll information.

2. Visual Presentation

Most people think that Excel can only be used to make elaborate spreadsheets. However, it is so much more than that. One of the biggest pros of doing payroll in Excel is its ability to be visually appealing. Let’s face it when you’re dealing with figures and calculations, who wouldn’t like it to look less dull?

Excel can take any data and turn it into charts, diagrams, or graphs. This is great for presentations and easy understanding of complicated payroll information. Not only that, when you visualize data in this manner, you can also draw parallels between parameters. This adds to a better cognizance of what your payroll numbers stand at and employee pay scales.

3. High Accuracy

Dealing with payroll figures can be a complex process. That is a no-brainer. Moreover, the bigger your company gets, the higher the number of transactions get. It can get truly difficult to not only track but also analyze these on a regular basis.

..and then comes payroll in Excel to the rescue. As I said, data manipulation is quite simple with this tool. Even formulas can be used as inputs for spreadsheets. What this does is it makes it effortless to insert numbers into specific locations on the spreadsheet itself. In addition, Excel will perform the necessary calculations automatically. As a result, you will end up putting absolutely no effort in obtaining payroll results. So not only are you saving tons of your valuable business time but also reducing the work you put in for this monthly task.

9 steps to carry out payroll in Excel

It is clear that Excel is a utilitarian application. But how do you really execute payroll in Excel? Here are the 9 key steps:

1. Launch MS Excel

Yes, we’re starting with the very basics. To open a new spreadsheet, launch MS Excel from the applications. This will open a blank Excel file for you to start on.

2. Save Files

The majority of the people believe in saving their file after completing work on it. While it is okay to do this for most file types, do not take the risk when it comes to payroll information. Do you want to spend hours creating a comprehensive sheet only to lose it at the very last minute? No.

Before you begin working on your payroll in Excel, save the file on a preferred location. Name the file suitably and store it at a place that you can have easy access to.

3. Setting up payroll parameters

The first step now is to create columns with payroll particulars. Consequently, this will ensure the data is stored systematically and values are entered accordingly in the parameters.

- Employee Name: Contains your employee name

- Hourly pay: The per hour pay rate

- Total Number of Hours Worked: Total hours worked by an employee.

- Hourly Overtime: Overtime rate per hour

- Total Number of Overtime Hours: Number of employee overtime

- Gross Salary: Payable amount without deductions

- Income Tax: Tax payable on Gross Salary

- Other Deductibles: Deductibles other than Income Tax such as EPF, PT, TDS, etc.

- Net Pay: In-hand salary for the employee

4. Data Entry

After you decide on the parameters that are relevant to your business, it is time to make data entries. Thus, add the column-wise details without adding any formula.

5. Gross Pay Calculation

Calculating gross salary is the first step before making any further calculations. Furthermore, it is calculated as the sum of the product of Hourly Pay, Total Number of Hours Worked and Hourly Overtime, Total Number of Overtime Hours. Here’s a simpler representation:

Also Read: Understanding salary structure in India

(Hourly Pay* Total Number of Hours Worked) + (Hourly Overtime * Total Number of Overtime Hours)

This can be calculated easily using the SUM and PROD functions in Excel. Moreover, once you have calculated it for one employee, simply drag down on the subsequent cells for ‘Employee Name’ to automatically get values for all employees.

6. Calculate Income Tax

To calculate Income Tax, check how much percentage tax is paid by the employee on his/her gross salary. make sure that you always calculate Income Tax on Gross Pay. In India, there are different tax slabs corresponding to various gross salaries received. The lowest income tax slab is 5% while the highest tax slab for individuals is 30%.

Also Read: 10 Tax saving tips you can benefit from today!

To calculate IT for different salaries, the formula is:

(-Income Tax percentage * Gross Salary)

For example, if it is 5%, the calculation will stand as -0.05 * taxable salary

7. Verify and Compute Deductions

This is a very important step as it relates to all tax deductibles applicable to employee salaries. These include Employee Provident Fund, Professional Tax, Public Provident Fund, Life/Health Insurance Premium, EMI on loans, etc. All investment declarations must be handled in a timely manner and proofs must be approved via workflow.

8. Formulate Net Salary

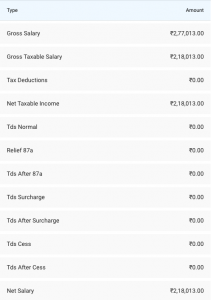

Net pay or salary is the actual amount that gets credited to the employee’s account. In addition, this is referred to as the in-hand salary and is the amount after all deductions are considered from gross salary.

So, to calculate Net Pay, the sum of Income Tax and Tax deductibles is subtracted from Gross Pay.

(Gross Pay – {Income Tax + Deductibles})

9. Evaluate all variables for payroll in Excel

Continue the above steps for every employee simply by dragging each cell downwards. Moreover, keep checking each value in every component. Lastly, add formatting to the cells and total all values at the end of the spreadsheet.

What next after payroll calculations in Excel?

Yay! You’ve successfully understood how to execute payroll in Excel. Now what? These are just various calculations. You can’t really send across this spreadsheet to employees because you don’t want everyone knowing each other’s salary. Neither can you print all of these, I mean you can, but its a lot of work and much more money. So let’s see how to build upon effective payroll practices following Excel calculations.

-

Making Salary Payments

All of this is well and good, but how will you efficiently pay your employees? With a payroll software, that’s how. Payroll software does everything for you once you have the final data. Moreover, it automates all your payments and ensures employee and financial confidentiality. Furthermore, it is all done by keeping in mind the deductibles and compliances needed to work within.

-

Generating and Distributing Payslips

This is another important payroll task. You see, manual payslips are equally time-consuming as manual payroll. Not to mention they are also prone to high levels of inaccuracies and human errors on a large scale. So what’s the next best thing? An online payslip generator! With this software, all you have to do is enter values from your collated Excel data. You will receive an instant payslip within seconds along with your company logo. In addition, your employees can receive their salary slips on their mobiles as well as on WhatsApp.

-

Customizing Emails for Employees

When it comes to sending salary slip emails to employees, customization is the best way to go. Additionally, you can use software like MailMerge which seamlessly integrates with Excel. MailMerge is typically used to combine official forms and emails.

Payroll in Excel: Is it the best option?

Just hear me out. Excel is good for payroll, but is it great? Not really.

The payroll process requires a lot of attention to detail at every step. Moreover, data entering and human error are not mutually exclusive. So what really is the best way to execute payroll? PAYROLL SOFTWARE!

Payroll Automation

Automating your payroll process is truly one of the best business decisions you will make. In addition to the automated calculations, software like Asanify can also organize annual reports and make tasks efficient.

Easy Reporting

Just like HR reports are essential, so are payroll reports. With payroll software, you can create, edit, and store all your payroll reports. These include weekly, monthly and yearly reports of collated data. Simultaneously, you can also get more simplified reports which provide all the information related to gross salary, deductibles, and net pay in a single report.

Data Confidentiality

Payroll software can also secure your data in a much more effective manner. At the same time, it allows for staff collaboration but ensures that data access is limited to certain parties only.

Payroll Compliance

Furthermore, we know how important a compliant payroll process is. Asanify provides comprehensive reports on Excel itself for efficient tax and compliance management. This helps you make reliable and accurate tax decisions.

Get started on a much more efficient payroll practice, there’s only so much Excel can do!

Summary

We’ve come to the end of this blog and I hope you have a clearer idea of how to execute payroll in Excel. We talked about 3 reasons you should use Excel for payroll and the various steps involved in that process. In conclusion, we looked at the actions to take after you complete calculating payroll variables on your Excel file.

FAQs

To carry out payroll on Excel, there are several steps right from collecting data to calculating payroll variables. Moreover, it can be a simple process if done correctly.

For calculating payroll time, the parameters required are the number of hours and minutes worked. Therefore, subtract the start time from the end time to obtain values for payroll time.

Yes, Excel has templates that include options for Schedules. As a result, you can use business schedules with preferred formats and styles.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.